RCFS

The East Africa Textile and Leather Week (EATLW) 2024 is shaping up to be the premier event for the textile, leather, and fashion industries in the East Africa region. Set to take place in Nairobi, Kenya, the week-long exhibition and trade show will bring together over 150 brands and more than 3,000 traders from 30 countries around the world.

Guest speakers during the conference on fashion entrepreneurship

EATLW 2024 promises to be an unrivaled platform for trade, networking, and showcasing the latest innovations from the region's textile, leather, and fashion sectors. With exhibitions, fashion shows, networking events, and more, attendees will get a comprehensive look at the best products and services the industries have to offer.

An exhibitor with a dazzling smile and vibrant energy in the 2023 edition [PHOTO EATLW]

An exhibitor with a dazzling smile and vibrant energy in the 2023 edition [PHOTO EATLW]

A highlight of the event will be a major fashion show featuring collections from 8 confirmed African designers representing different countries across the continent. The fashion show will provide a spotlight for Africa's rising fashion talents and shine a light on the creativity and craftsmanship of the region's designers.

Kenyan model Merab Achola in a collection that will be showcased at the EATLW 2024 [PHOTO EATLW]

Kenyan model Merab Achola in a collection that will be showcased at the EATLW 2024 [PHOTO EATLW]

"We are tremendously excited to host EATLW 2024 here in Nairobi, East Africa's textile, leather, and fashion industries are brimming with potential. This event will connect our region's businesses and artisans with trade partners from around the world while also elevating homegrown talents on a global stage." said the event's organizer.

EATLW 2024 is expected to generate significant business opportunities, new trade partnerships, and investments in East Africa's crucial textile, leather, and fashion sectors. It marks a major milestone for these industries in the region gaining more international prominence and recognition.

Guest speakers during the conference on customer focus

With seminal networking events, fashion shows, and exhibitions already confirmed and more to be announced in the coming week, EATLW 2024 is shaping up to be an unmissable event. So far 8 fashion brands have confirmed to showcase their designs during the EATLW 2024 runway show.

SPINNERS & SPINNERS will showcase at the EATLW 2024 [PHOTO EATLW]

SPINNERS & SPINNERS will showcase at the EATLW 2024 [PHOTO EATLW]

Spinners&Spinners A vertically integrated textile design and manufacturing company, they oversee every stage, from fiber to fashion. Founded in 1979 in Kenya, Spinners & Spinners Ltd (S&S) boasts a rich entrepreneurial legacy within the region.

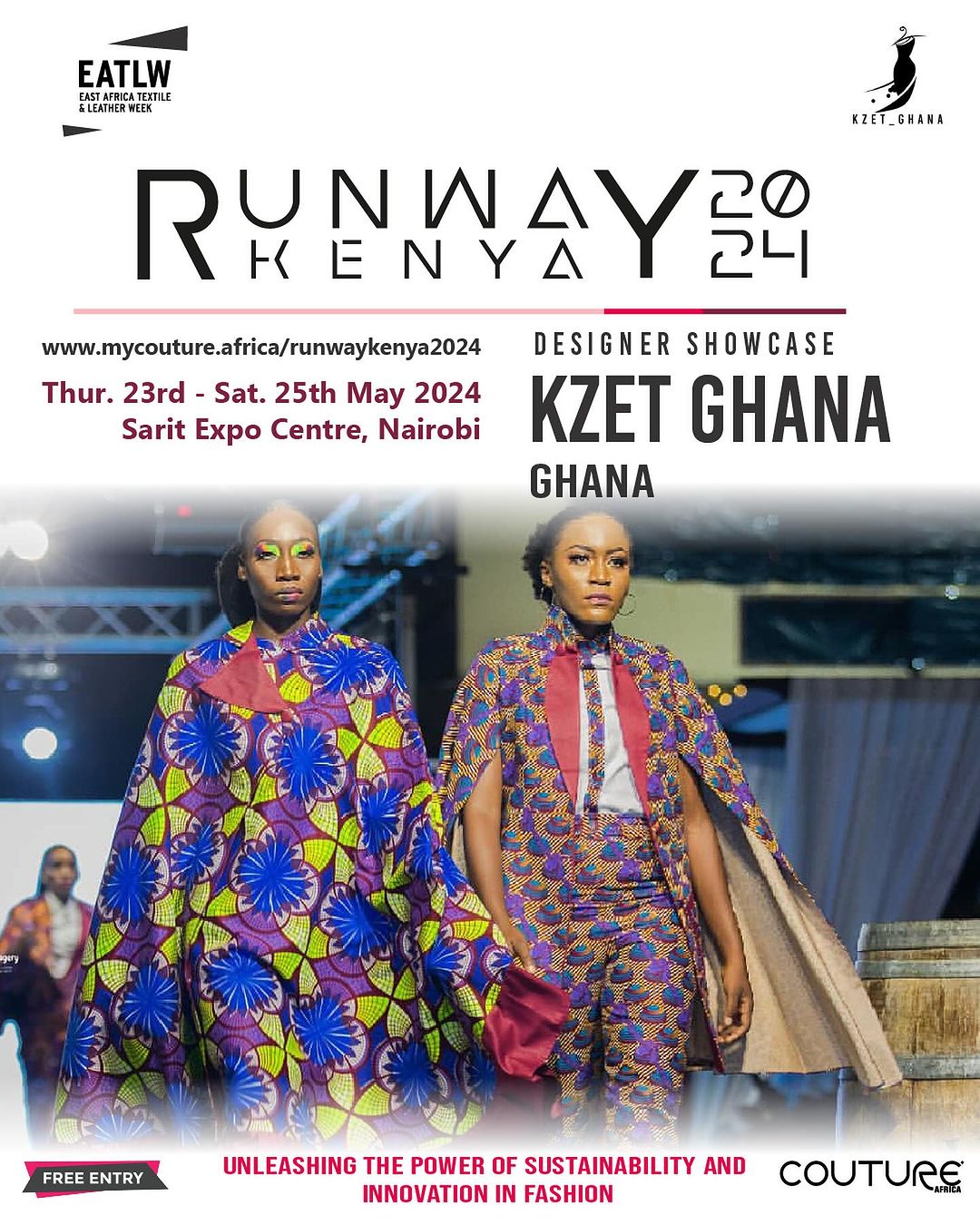

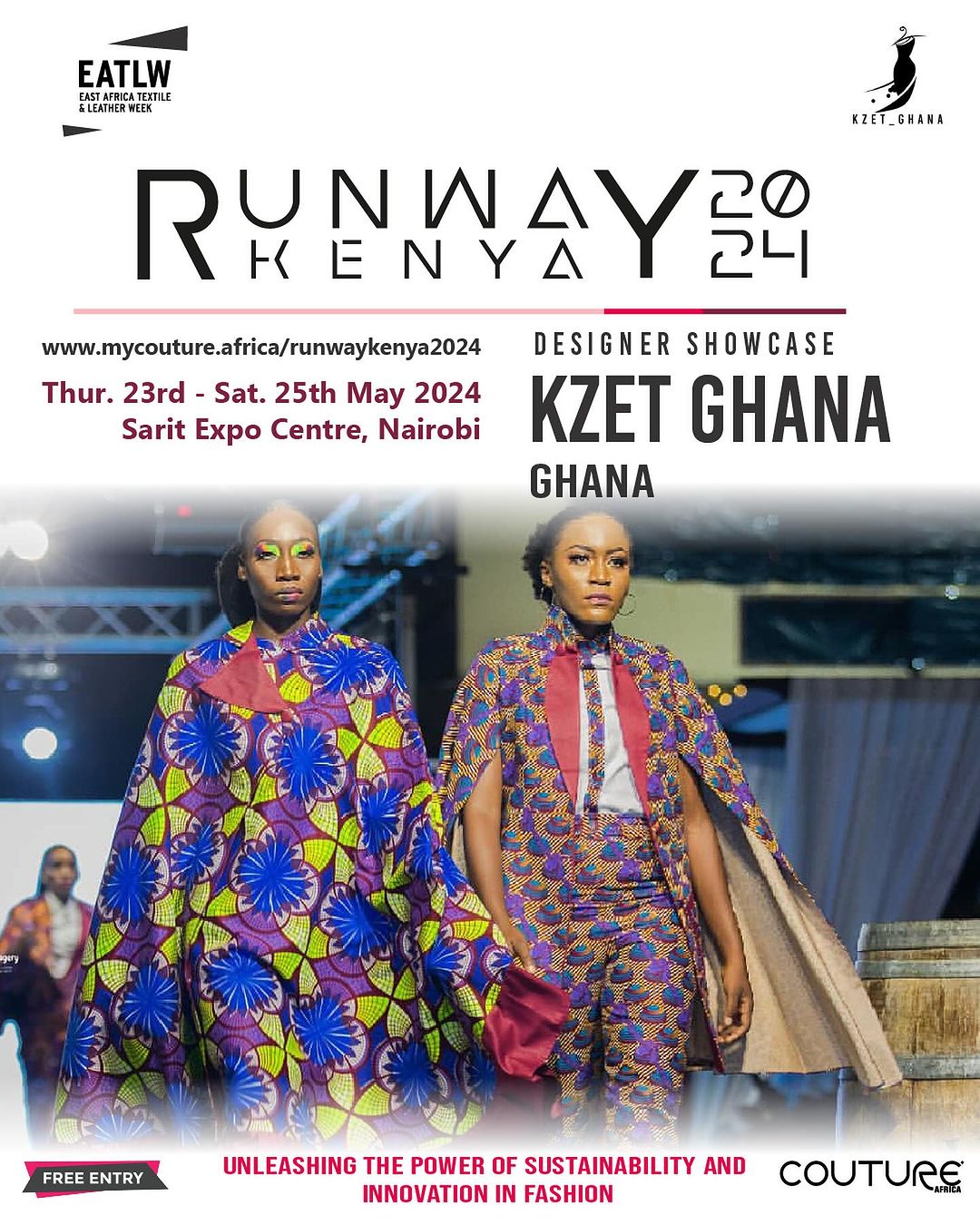

A specialist in stunning fashion for both ladies and gentlemen the KZET from Ghana will showcase at the EATLW 2024 [PHOTO EATLW]

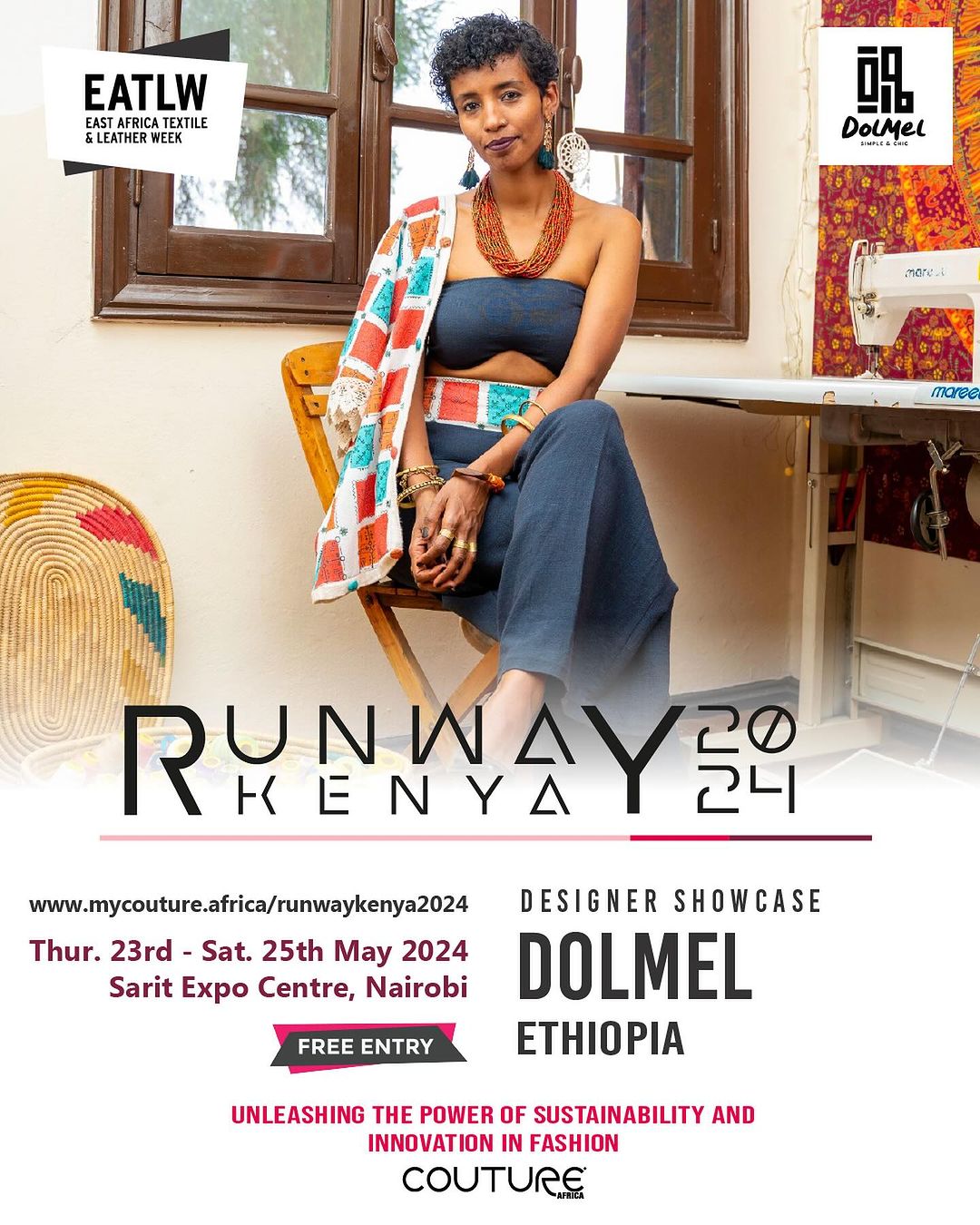

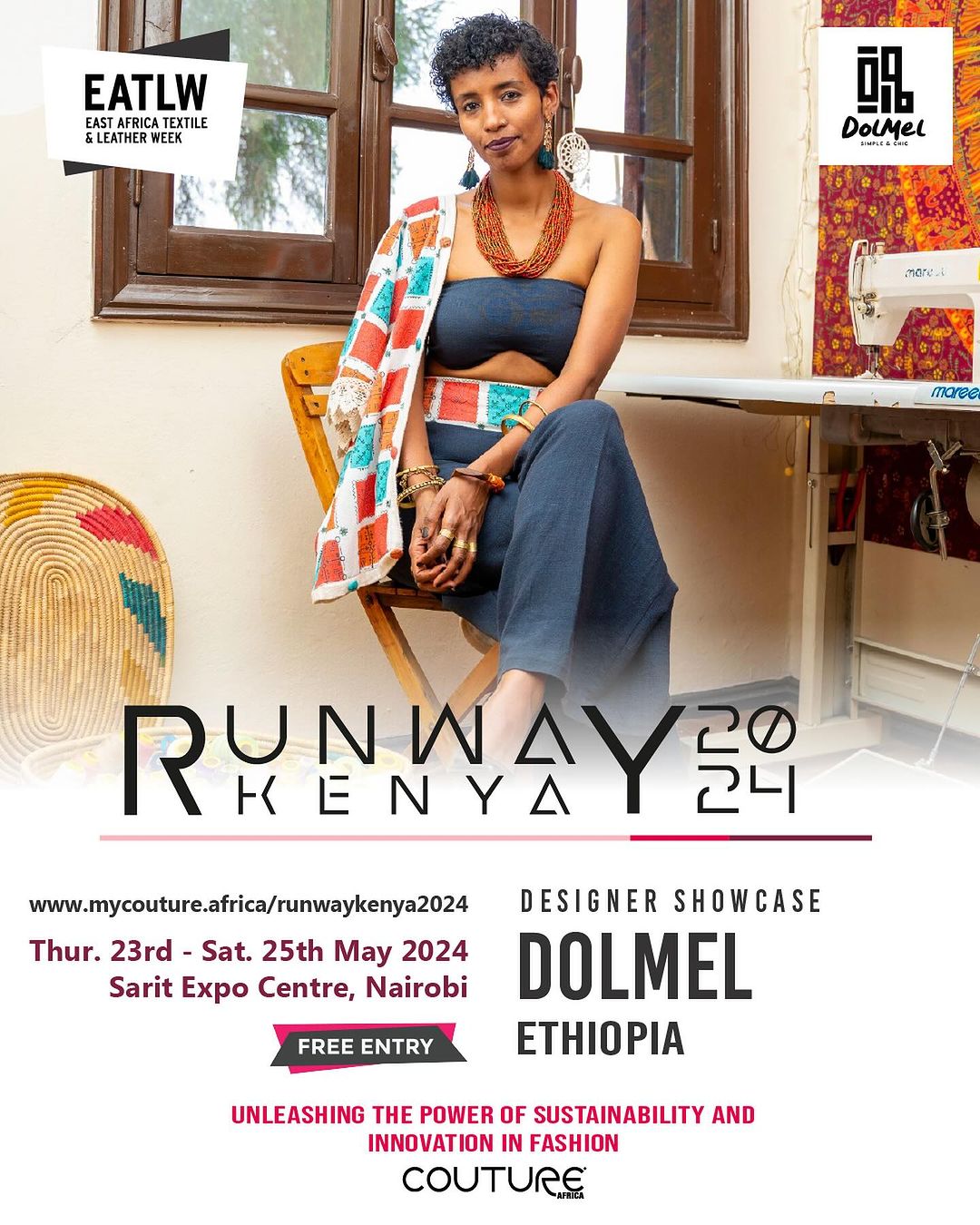

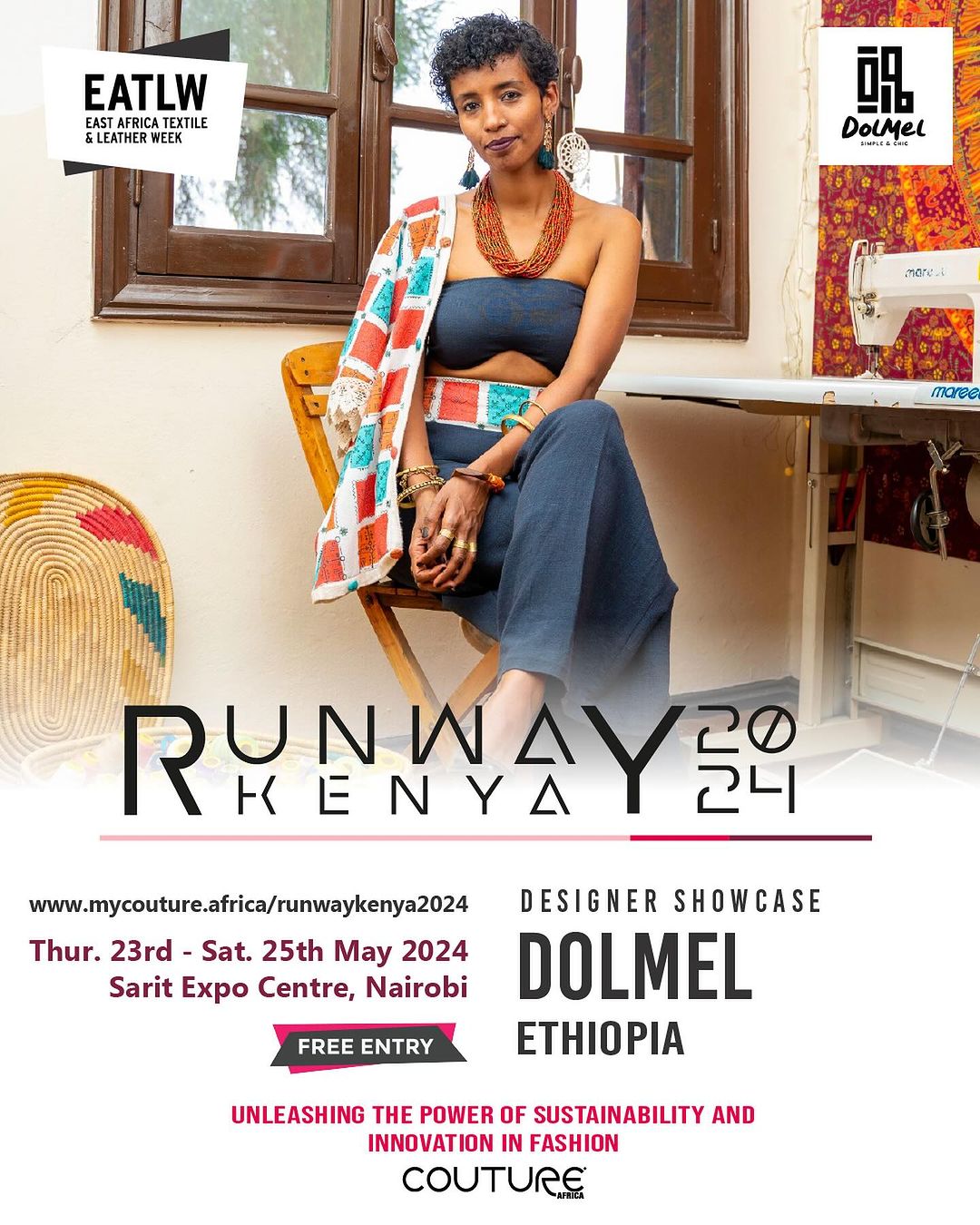

DOLMEL from Ethiopia will showcase at the EATLW 2024 [PHOTO EATLW]

DOLMEL from Ethiopia will showcase at the EATLW 2024 [PHOTO EATLW]

DolMel is an Ethiopian fashion brand bringing a unique approach that pushes the millennia-old tradition of hand-weaving into the 21st century. They do this by using high-tech digital reactive printing to produce rolls of various kinds of seamless patterns on a cotton hand-woven fabric. This later turns into bohemian inspired clothes that celebrates and expresses one’s unique identity.

F &M will showcase at the EATLW 2024 [PHOTO EATLW]

F &M will showcase at the EATLW 2024 [PHOTO EATLW]

F&M (Fashion and Ministry) Brand is a faith-based fashion brand based in Nairobi, Kenya. The Made in Kenya brand believes in dressing a person externally with edgy, fashion forward and exclusive designs but more so to dress them internally with grace, with power and with the wholesome word of God. They are a Fashion brand with a difference.

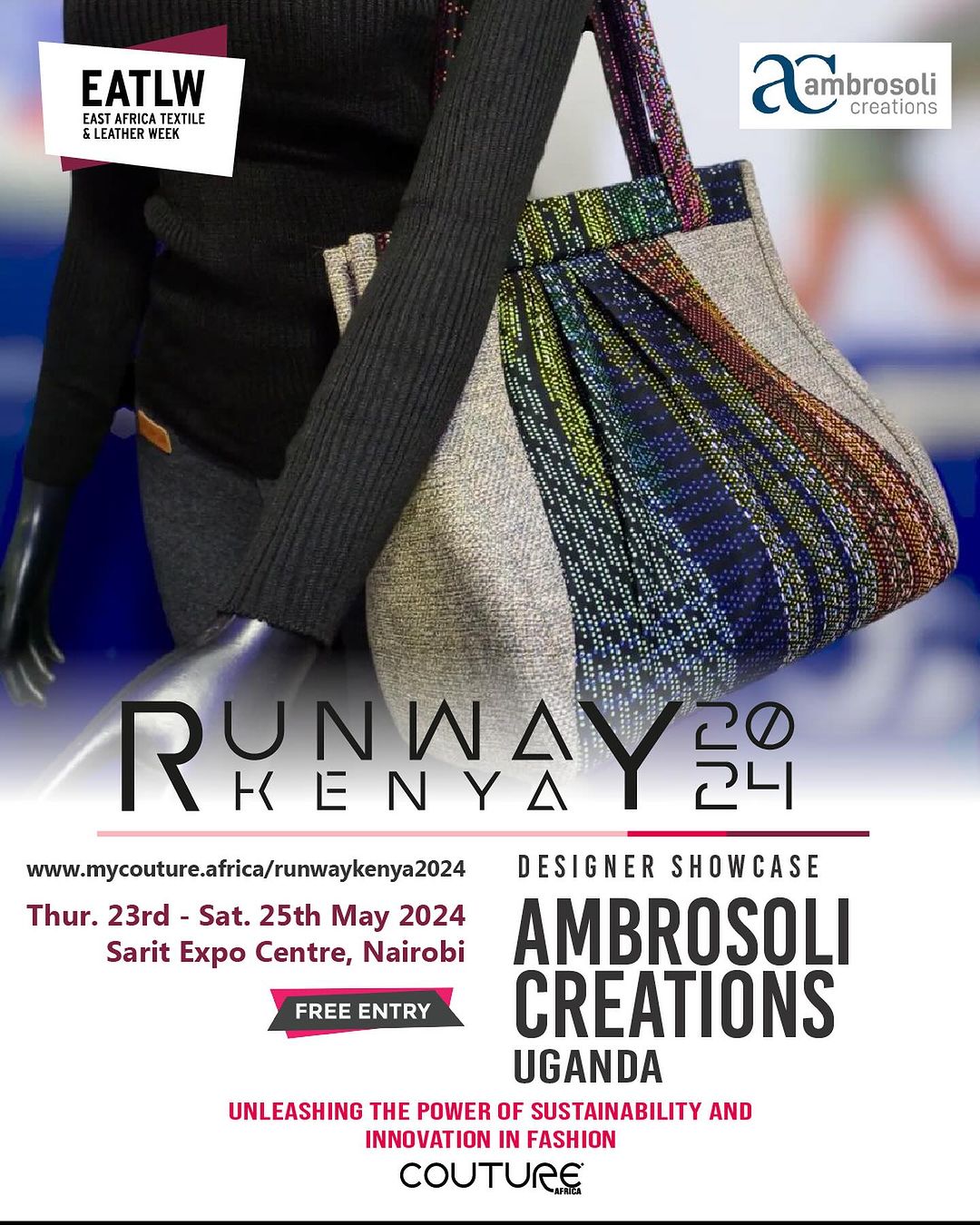

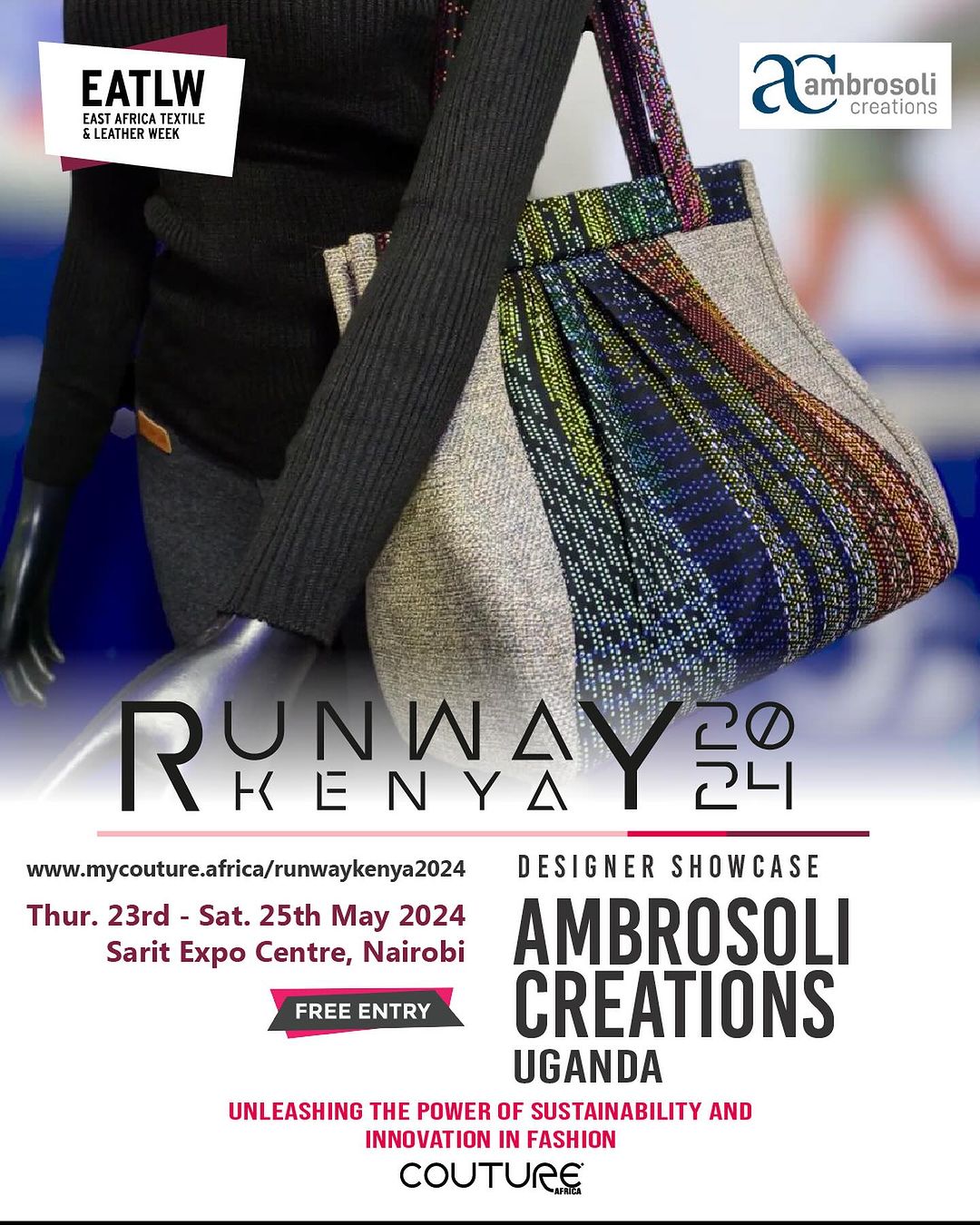

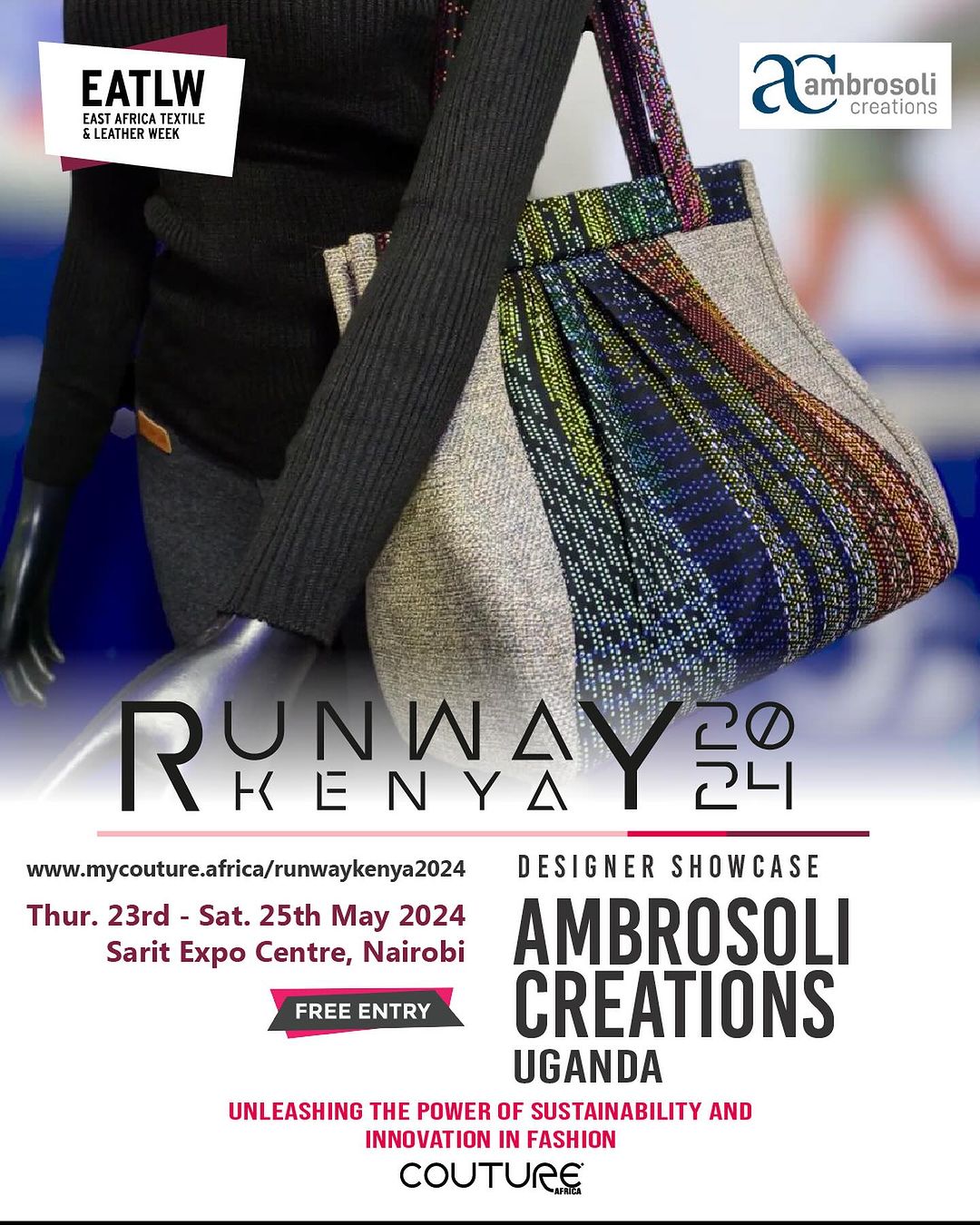

Ambrosoli Creations from Uganda will showcase at the EATLW 2024 [PHOTO EATLW]

Ambrosoli Creations, spearheaded by Ambrose Angulo are manufacturers of branded and non-branded bags with an african touch. Based in Kampala, Uganda, they specialise in all sorts of bags for both women and men including backpacks, totes, handbags and travel bags with canvas, denim and leather being their core mediums.

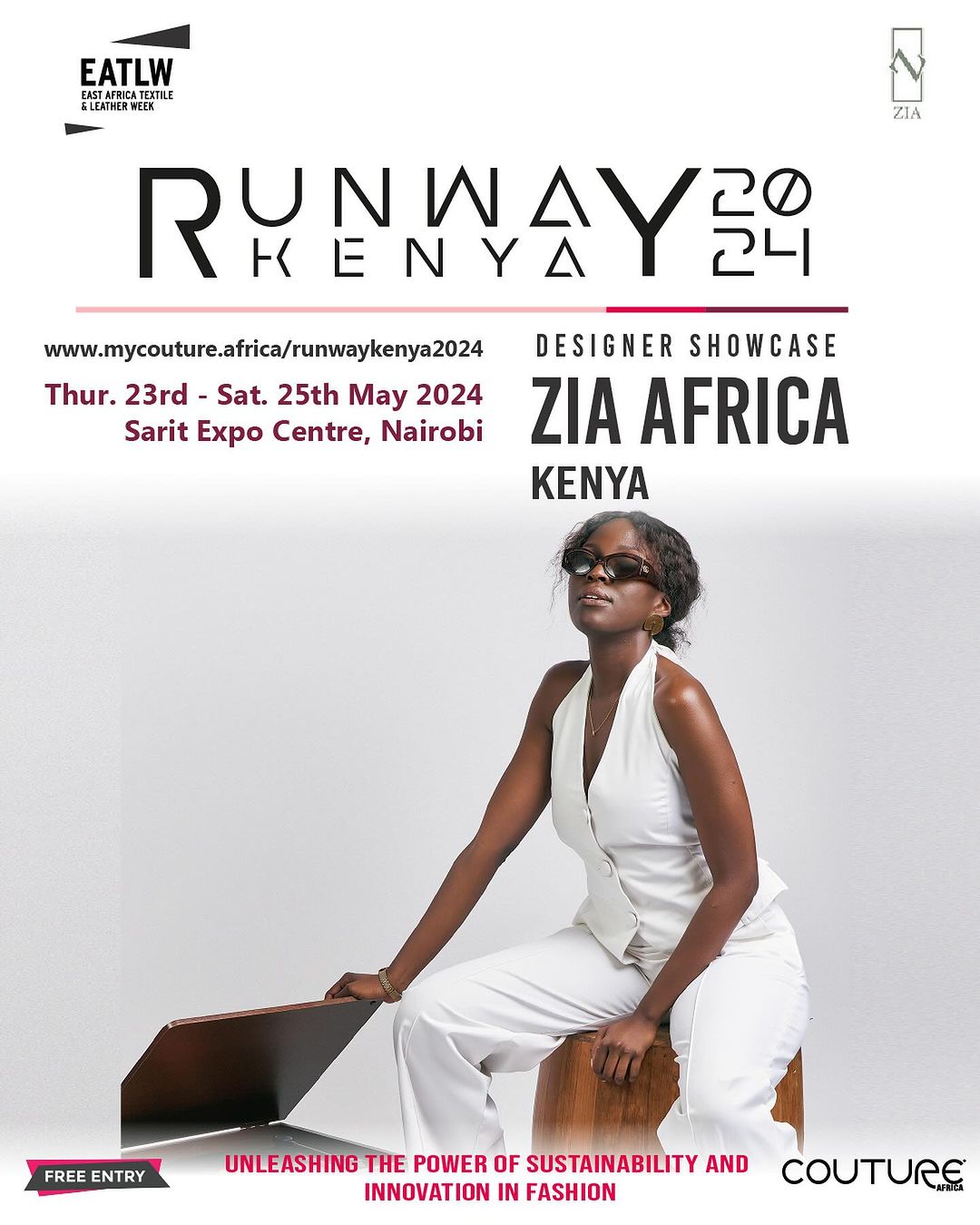

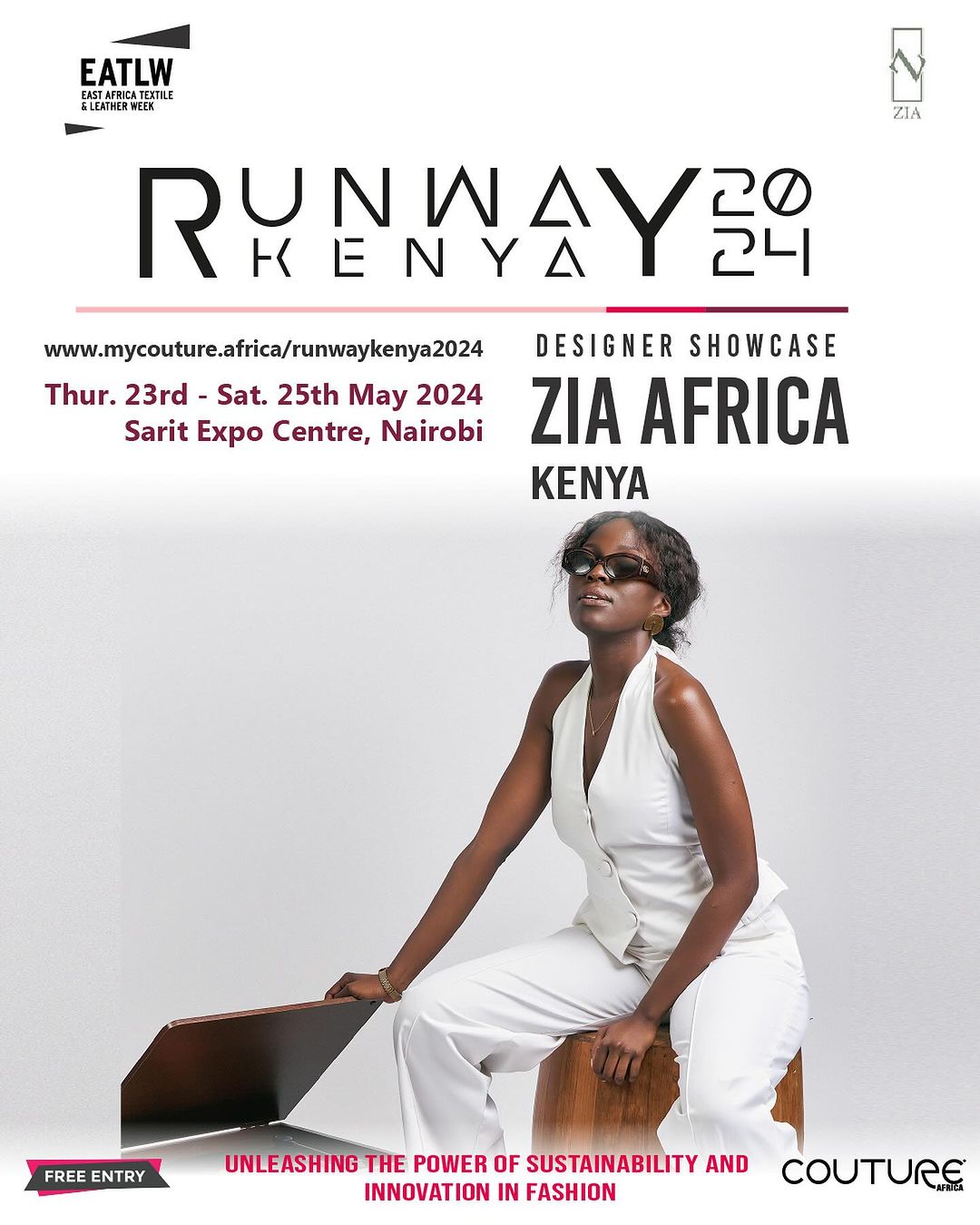

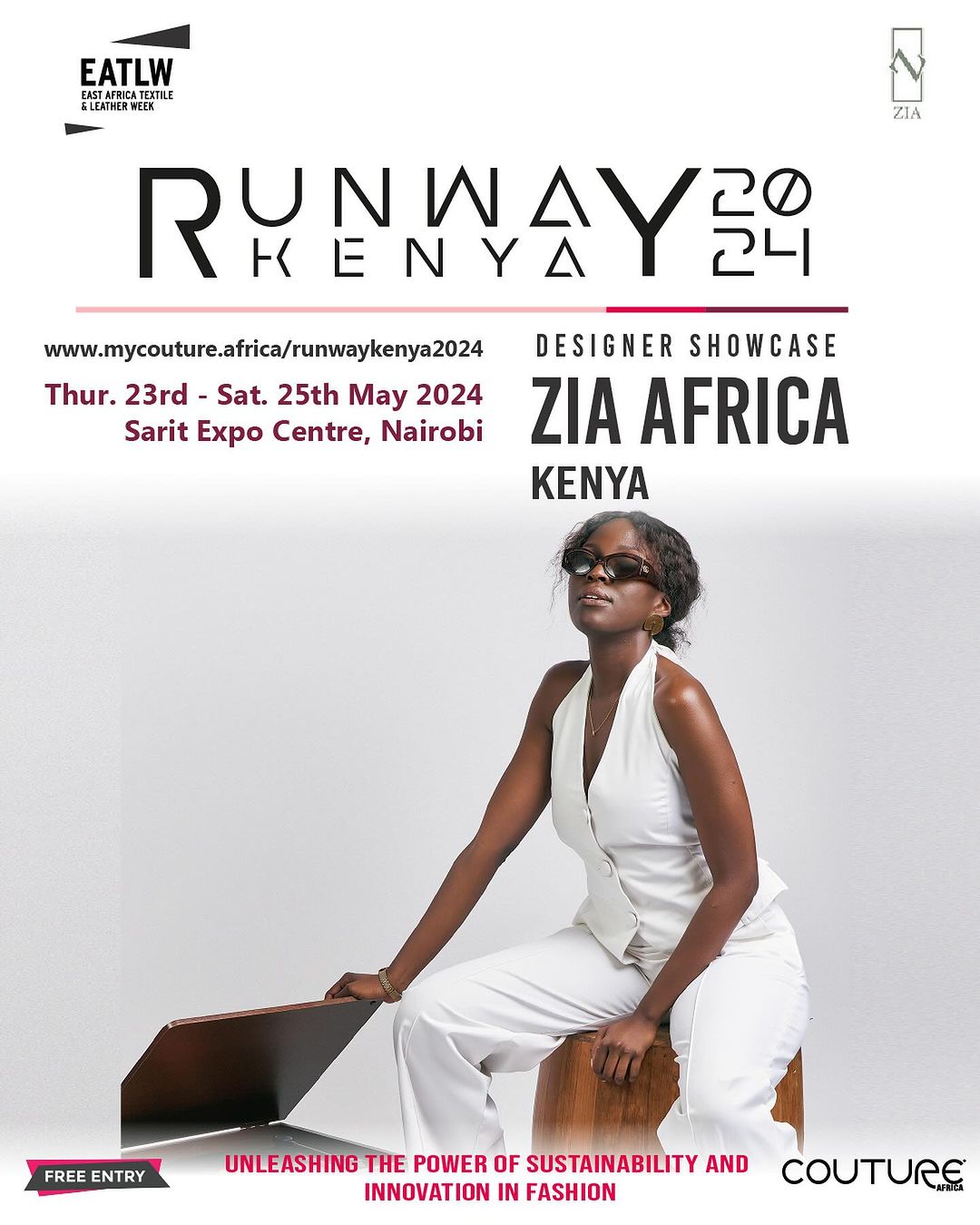

ZIA Africa will showcase at the EATLW 2024 [PHOTO EATLW]

ZIA Africa will showcase at the EATLW 2024 [PHOTO EATLW]

Since 2013, Zia has revolutionized Kenyan fashion by championing sustainability. This #MadeInKenya brand offers timeless, high-quality pieces for the modern, aspirational woman. Committed to eco-friendly practices, Zia believes fashion shouldn’t harm the planet. By 2025, their goal is to become Africa’s leading sustainable fashion platform.

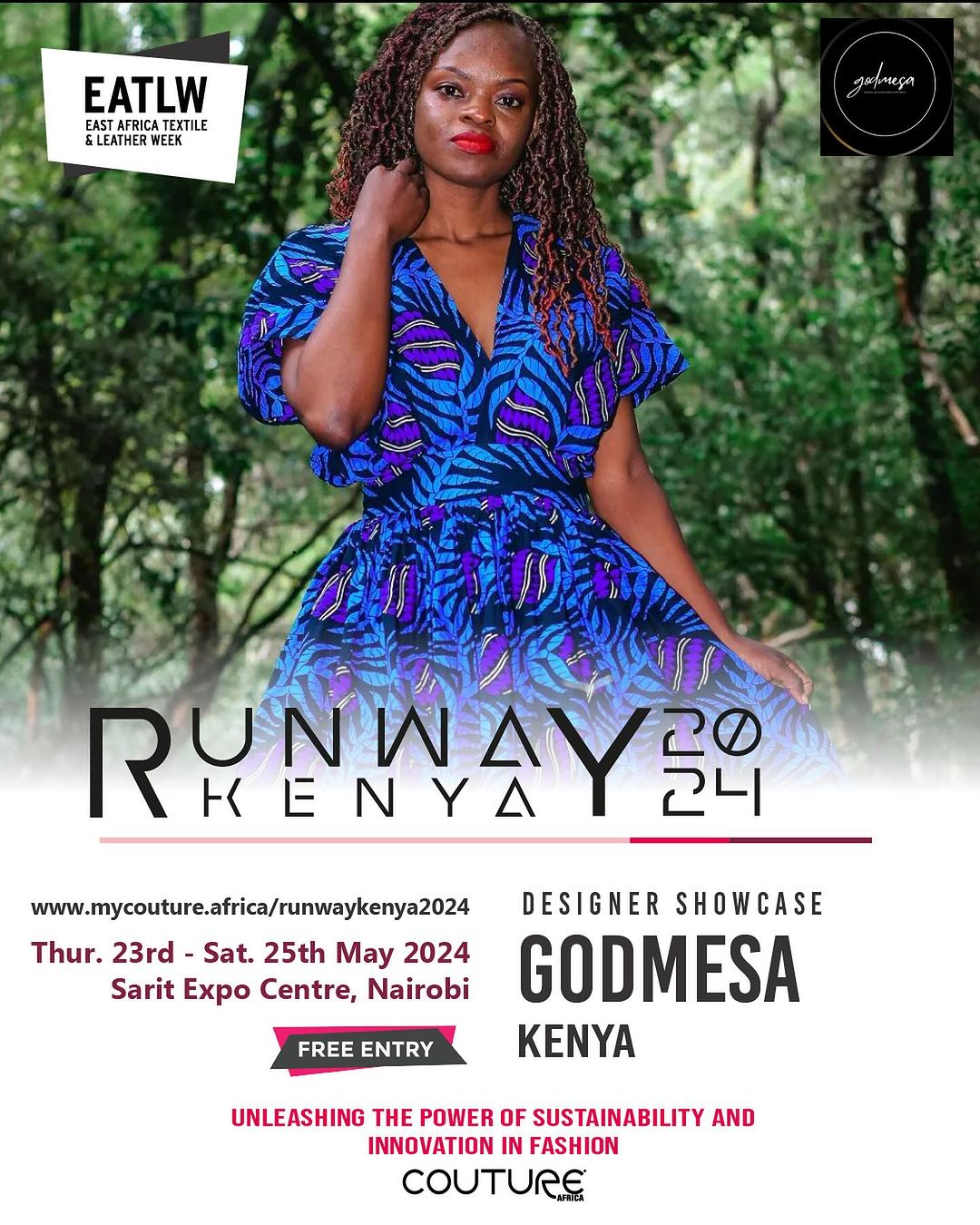

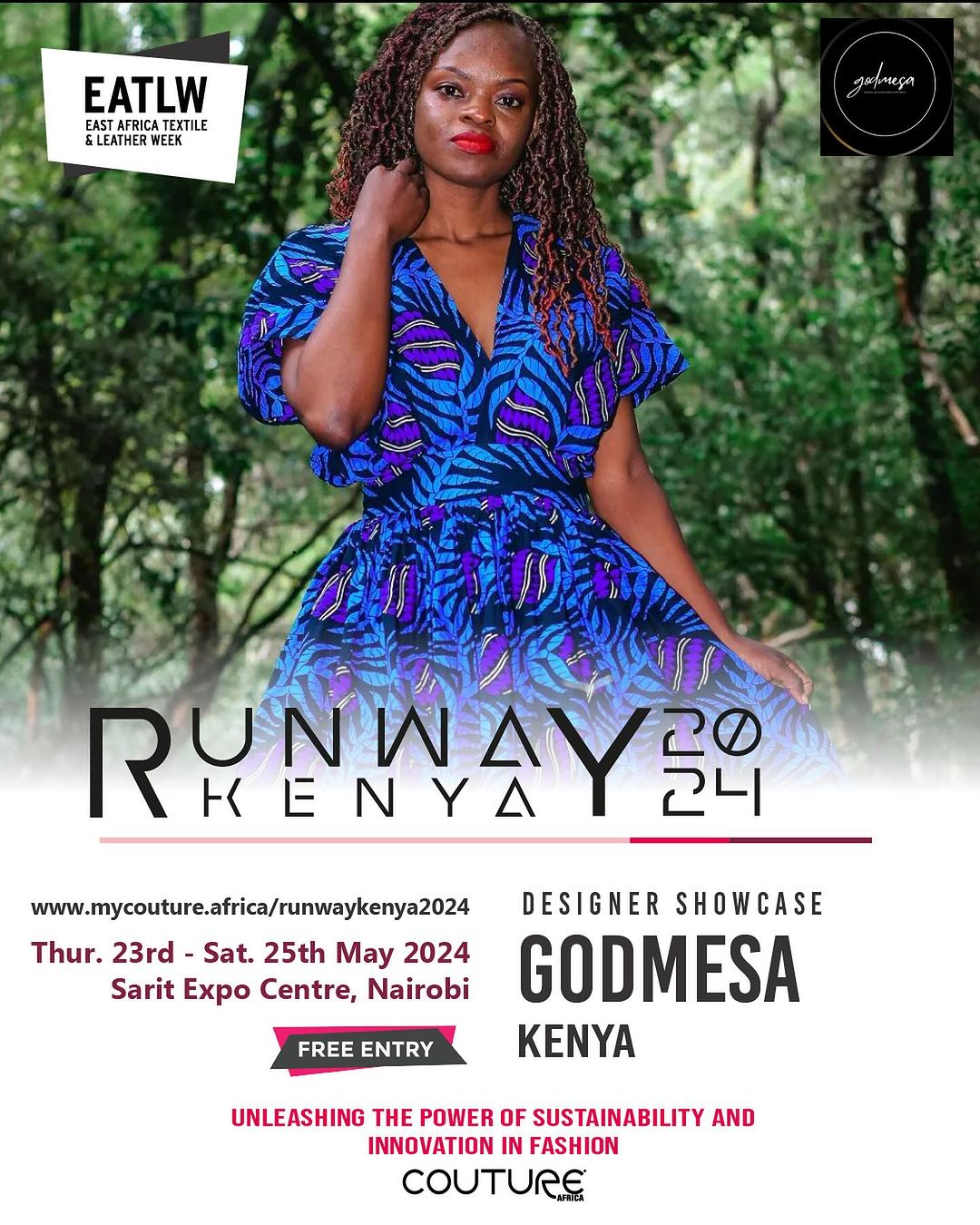

Godmesa will showcase at the EATLW 2024 [PHOTO EATLW]

Godmesa will showcase at the EATLW 2024 [PHOTO EATLW]

Godmesa is a Kenyan fashion brand dedicated to making their clients feel good, feel confident, and have fun with fashion. Their cutting-edge designs push boundaries and redefine style, celebrating individuality and bold expression.

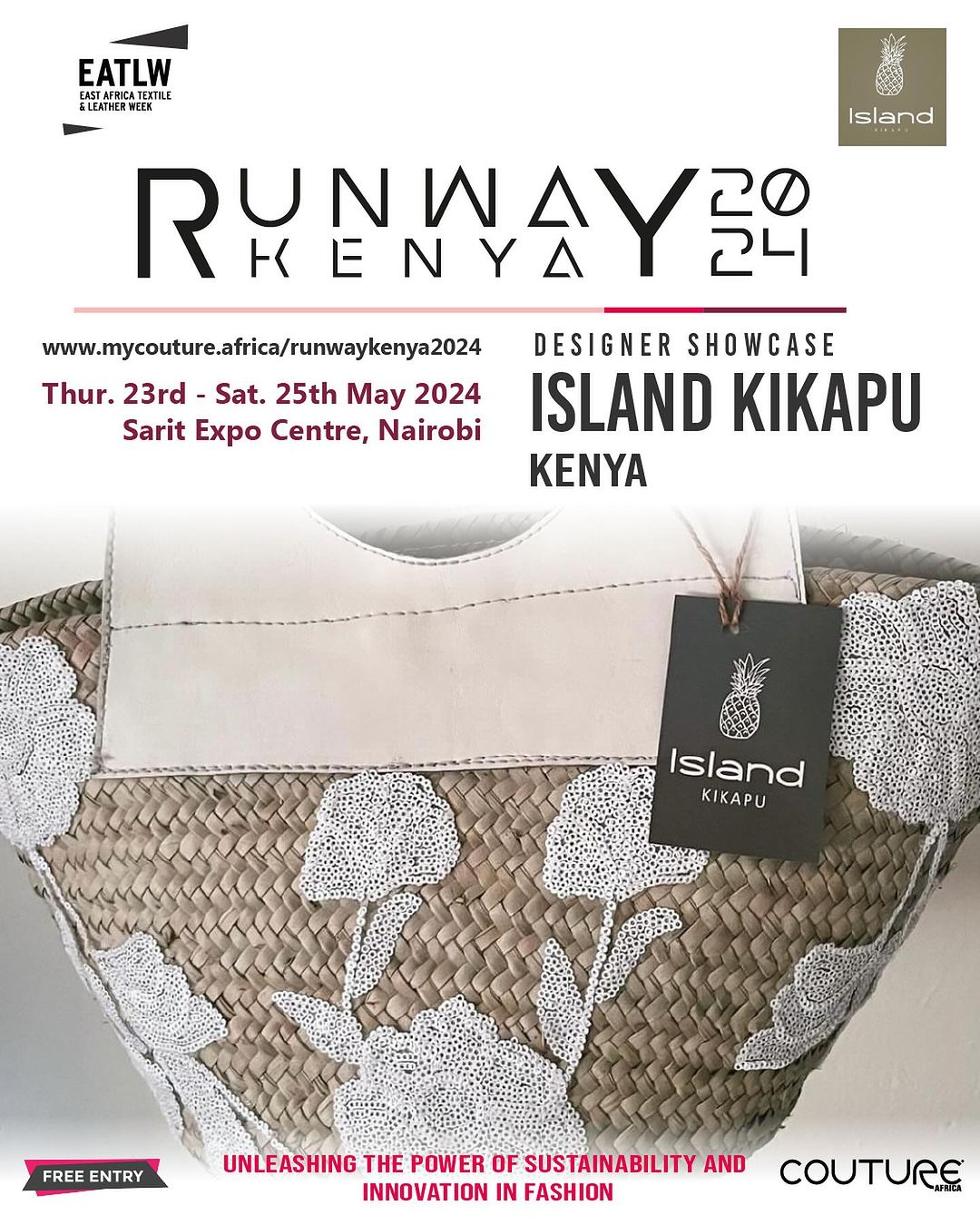

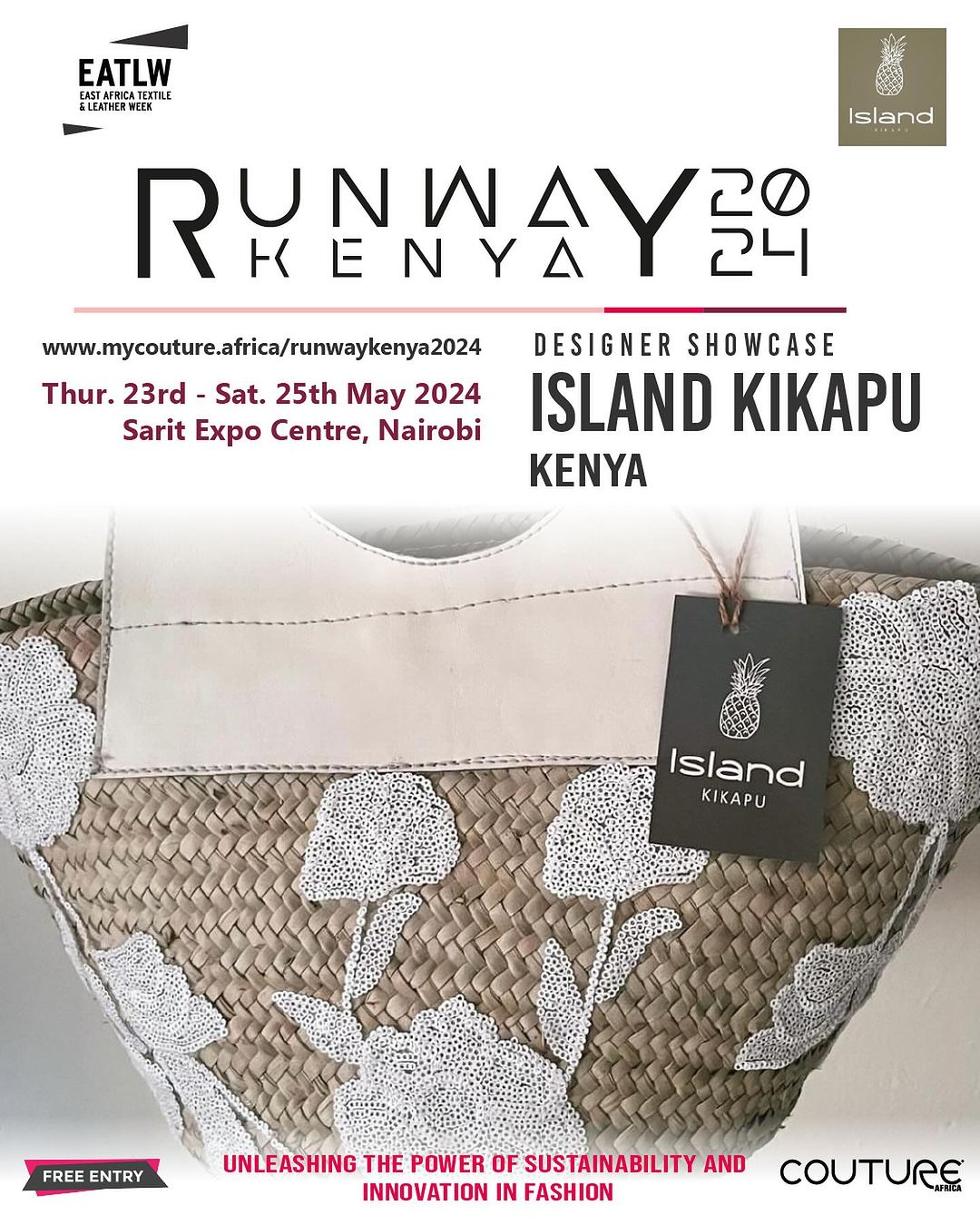

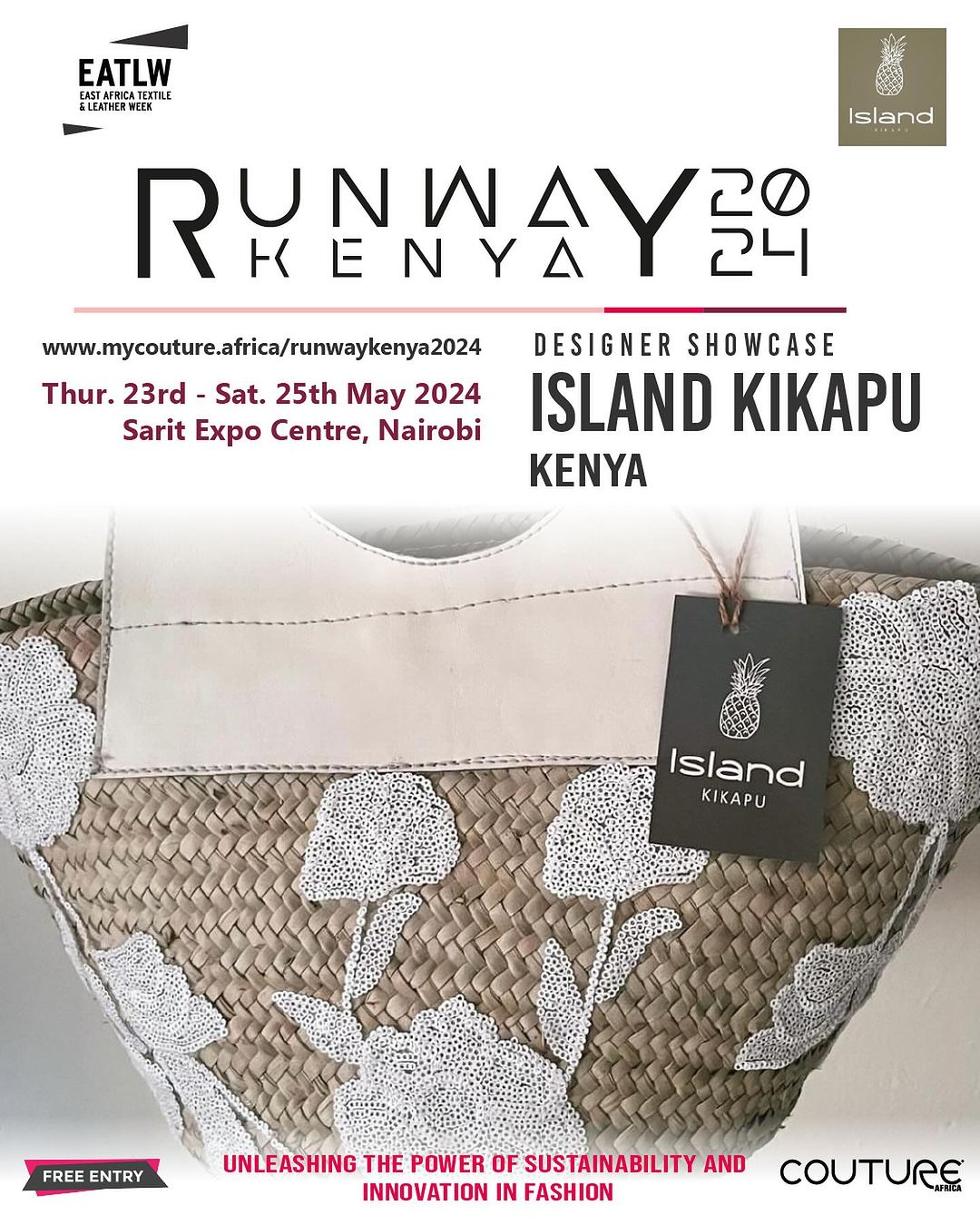

ISLAND KIKAPU will showcase at the EATLW 2024 [PHOTO EATLW]

ISLAND KIKAPU will showcase at the EATLW 2024 [PHOTO EATLW]

Island Kikapus, brings you unique baskets that merge luxurious fashion and style, perfect for every season and mission. Transforming local woven baskets into versatile works of art with leather and decorations like never before. Each basket is hand-painted and adorned with artistic decorations such as flowers, sequins, embroidery, and various accessories

The East Africa Textile and Leather Week (EATLW) 2024 is shaping up to be the premier event for the textile, leather, and fashion industries in the East Africa region. Set to take place in Nairobi, Kenya, the week-long exhibition and trade show will bring together over 150 brands and more than 3,000 traders from 30 countries around the world.

Guest speakers during the conference on fashion entrepreneurship

EATLW 2024 promises to be an unrivaled platform for trade, networking, and showcasing the latest innovations from the region's textile, leather, and fashion sectors. With exhibitions, fashion shows, networking events, and more, attendees will get a comprehensive look at the best products and services the industries have to offer.

An exhibitor with a dazzling smile and vibrant energy in the 2023 edition [PHOTO EATLW]

An exhibitor with a dazzling smile and vibrant energy in the 2023 edition [PHOTO EATLW]

A highlight of the event will be a major fashion show featuring collections from 8 confirmed African designers representing different countries across the continent. The fashion show will provide a spotlight for Africa's rising fashion talents and shine a light on the creativity and craftsmanship of the region's designers.

Kenyan model Merab Achola in a collection that will be showcased at the EATLW 2024 [PHOTO EATLW]

Kenyan model Merab Achola in a collection that will be showcased at the EATLW 2024 [PHOTO EATLW]

"We are tremendously excited to host EATLW 2024 here in Nairobi, East Africa's textile, leather, and fashion industries are brimming with potential. This event will connect our region's businesses and artisans with trade partners from around the world while also elevating homegrown talents on a global stage." said the event's organizer.

EATLW 2024 is expected to generate significant business opportunities, new trade partnerships, and investments in East Africa's crucial textile, leather, and fashion sectors. It marks a major milestone for these industries in the region gaining more international prominence and recognition.

Guest speakers during the conference on customer focus

With seminal networking events, fashion shows, and exhibitions already confirmed and more to be announced in the coming week, EATLW 2024 is shaping up to be an unmissable event. So far 8 fashion brands have confirmed to showcase their designs during the EATLW 2024 runway show.

SPINNERS & SPINNERS will showcase at the EATLW 2024 [PHOTO EATLW]

SPINNERS & SPINNERS will showcase at the EATLW 2024 [PHOTO EATLW]

Spinners&Spinners A vertically integrated textile design and manufacturing company, they oversee every stage, from fiber to fashion. Founded in 1979 in Kenya, Spinners & Spinners Ltd (S&S) boasts a rich entrepreneurial legacy within the region.

A specialist in stunning fashion for both ladies and gentlemen the KZET from Ghana will showcase at the EATLW 2024 [PHOTO EATLW]

DOLMEL from Ethiopia will showcase at the EATLW 2024 [PHOTO EATLW]

DOLMEL from Ethiopia will showcase at the EATLW 2024 [PHOTO EATLW]

DolMel is an Ethiopian fashion brand bringing a unique approach that pushes the millennia-old tradition of hand-weaving into the 21st century. They do this by using high-tech digital reactive printing to produce rolls of various kinds of seamless patterns on a cotton hand-woven fabric. This later turns into bohemian inspired clothes that celebrates and expresses one’s unique identity.

F &M will showcase at the EATLW 2024 [PHOTO EATLW]

F &M will showcase at the EATLW 2024 [PHOTO EATLW]

F&M (Fashion and Ministry) Brand is a faith-based fashion brand based in Nairobi, Kenya. The Made in Kenya brand believes in dressing a person externally with edgy, fashion forward and exclusive designs but more so to dress them internally with grace, with power and with the wholesome word of God. They are a Fashion brand with a difference.

Ambrosoli Creations from Uganda will showcase at the EATLW 2024 [PHOTO EATLW]

Ambrosoli Creations, spearheaded by Ambrose Angulo are manufacturers of branded and non-branded bags with an african touch. Based in Kampala, Uganda, they specialise in all sorts of bags for both women and men including backpacks, totes, handbags and travel bags with canvas, denim and leather being their core mediums.

ZIA Africa will showcase at the EATLW 2024 [PHOTO EATLW]

ZIA Africa will showcase at the EATLW 2024 [PHOTO EATLW]

Since 2013, Zia has revolutionized Kenyan fashion by championing sustainability. This #MadeInKenya brand offers timeless, high-quality pieces for the modern, aspirational woman. Committed to eco-friendly practices, Zia believes fashion shouldn’t harm the planet. By 2025, their goal is to become Africa’s leading sustainable fashion platform.

Godmesa will showcase at the EATLW 2024 [PHOTO EATLW]

Godmesa will showcase at the EATLW 2024 [PHOTO EATLW]

Godmesa is a Kenyan fashion brand dedicated to making their clients feel good, feel confident, and have fun with fashion. Their cutting-edge designs push boundaries and redefine style, celebrating individuality and bold expression.

ISLAND KIKAPU will showcase at the EATLW 2024 [PHOTO EATLW]

ISLAND KIKAPU will showcase at the EATLW 2024 [PHOTO EATLW]

Island Kikapus, brings you unique baskets that merge luxurious fashion and style, perfect for every season and mission. Transforming local woven baskets into versatile works of art with leather and decorations like never before. Each basket is hand-painted and adorned with artistic decorations such as flowers, sequins, embroidery, and various accessories

Chantal Murebwa grew New Kigali Designers and Outfitters from a small venture with just two tailors and one sewing machine, into a thriving fashion company.

Standing in front of a two-storey brick building, Chantal Murebwa admires the crisp white paint. She has witnessed the entire journey of this structure: from its foundations being laid to its transformation into New Kigali Designers and Outfitters, a thriving garment factory. Located close to the Kigali Genocide Memorial, the company founded by Murebwa employs 280 workers. In the reception area, an array of finished garments, including t-shirts, coats, overalls, and shirts, all in vibrant colors, is displayed. In the cutting room, workers operate machines that precisely cut collars and sleeves.

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

The production room, where cut garment pieces are assembled, is on the second floor. State-of-the-art tailoring machines hum as workers in matching black t-shirts, emblazoned with the factory’s motto ‘Home of tailor-made garments and branding’, tend to their tasks. In the finishing room, the assembled garments undergo ironing, quality checks, and packaging by the factory’s staff.

A humble beginning

It all began in 1995 when Murebwa was just 24, in the aftermath of the 1994 genocide, a devastating period for the country.

“There were a lot of challenges but also opportunities. I was inspired by my passion for fashion and women’s empowerment. When I started, I had one sewing machine and two women staff, and we were focusing on enlarging or reducing the size of women’s clothes. We later secured a gig to make uniforms for security guards and progressed,” the entrepreneur explains.

Chantal Umurerwa, the Managing Director of Kigali Designers and Outfitters interacts with Thomas Ostros, European Investment Bank (EIB Global) Vice President[PHOTO NT]

Chantal Umurerwa, the Managing Director of Kigali Designers and Outfitters interacts with Thomas Ostros, European Investment Bank (EIB Global) Vice President[PHOTO NT]

Murebwa registered New Kigali Designers and Outfitters as a company in 1998, initially employing five tailors. By 2005, her workshop had expanded to include 20 tailors. Recognizing the high demand and numerous opportunities for growth, Murebwa began seeking financial support.

“I obtained a loan from BCDI, now Ecobank, by showing them a contract I had won to produce uniforms for security guards, and I repaid it well,” she says. “Then, in 2003, the Bank of Kigali extended another loan to me for acquiring the land where we constructed this factory.”

Since its establishment, the factory’s clientele includes both corporate entities and individuals, with a growing presence across all provinces of Rwanda.

European Investment Bank (EIB Global) Vice President Thomas Ostros, visiting the garment factory[PHOTO NT]

European Investment Bank (EIB Global) Vice President Thomas Ostros, visiting the garment factory[PHOTO NT]

Challenges and future endeavours

The size of the apparel market in Rwanda, as of 2024, was $426.10 million, with a projected annual growth rate of 3.41% between 2024 and 2028. A 2023 UNESCO report, The fashion sector in Africa: Trends, challenges, and opportunities for growth, highlights Africa as one of the next frontiers for fashion. Rwanda is also listed as an African country with a growing local high-fashion luxury brand presence.

Despite these positive trends, Murebwa still faces challenges that hinder her work. She identified access to finance as a major obstacle. Moreover, the impact of the strong US dollar is a concern, as her company relies on importing all its raw materials.

“Delays in shipping also disrupt my factory’s workflow when urgent orders are required,” she says.

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of the garment factory at Gisozi in Kigali[PHOTO NT]

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of the garment factory at Gisozi in Kigali[PHOTO NT]

“Acquiring skilled manpower remains a challenge, especially for roles like textile engineers and quality assurance personnel, as they are costly to hire from abroad. I suggest that the government establish faculties related to these trades in universities to develop local talent,” she adds.

On a personal note, Murebwa continues to grapple with balancing her work life and family commitments. Her business requires a significant time investment, and she often finds herself struggling to find a balance. Looking ahead, Murebwa’s New Kigali Designers and Outfitters is in the final stages of opening a second phase of its factory at the Kigali Special Economic Zone.

“The new phase will house 300 staff [in addition to the 280 already employed] and incorporate high-tech machinery. This will enhance our ability to target export markets. Our focus will be on producing a variety of t-shirts to ensure affordability for all,” Murebwa says.

New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

Chantal Murebwa grew New Kigali Designers and Outfitters from a small venture with just two tailors and one sewing machine, into a thriving fashion company.

Standing in front of a two-storey brick building, Chantal Murebwa admires the crisp white paint. She has witnessed the entire journey of this structure: from its foundations being laid to its transformation into New Kigali Designers and Outfitters, a thriving garment factory. Located close to the Kigali Genocide Memorial, the company founded by Murebwa employs 280 workers. In the reception area, an array of finished garments, including t-shirts, coats, overalls, and shirts, all in vibrant colors, is displayed. In the cutting room, workers operate machines that precisely cut collars and sleeves.

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

The production room, where cut garment pieces are assembled, is on the second floor. State-of-the-art tailoring machines hum as workers in matching black t-shirts, emblazoned with the factory’s motto ‘Home of tailor-made garments and branding’, tend to their tasks. In the finishing room, the assembled garments undergo ironing, quality checks, and packaging by the factory’s staff.

A humble beginning

It all began in 1995 when Murebwa was just 24, in the aftermath of the 1994 genocide, a devastating period for the country.

“There were a lot of challenges but also opportunities. I was inspired by my passion for fashion and women’s empowerment. When I started, I had one sewing machine and two women staff, and we were focusing on enlarging or reducing the size of women’s clothes. We later secured a gig to make uniforms for security guards and progressed,” the entrepreneur explains.

Chantal Umurerwa, the Managing Director of Kigali Designers and Outfitters interacts with Thomas Ostros, European Investment Bank (EIB Global) Vice President[PHOTO NT]

Chantal Umurerwa, the Managing Director of Kigali Designers and Outfitters interacts with Thomas Ostros, European Investment Bank (EIB Global) Vice President[PHOTO NT]

Murebwa registered New Kigali Designers and Outfitters as a company in 1998, initially employing five tailors. By 2005, her workshop had expanded to include 20 tailors. Recognizing the high demand and numerous opportunities for growth, Murebwa began seeking financial support.

“I obtained a loan from BCDI, now Ecobank, by showing them a contract I had won to produce uniforms for security guards, and I repaid it well,” she says. “Then, in 2003, the Bank of Kigali extended another loan to me for acquiring the land where we constructed this factory.”

Since its establishment, the factory’s clientele includes both corporate entities and individuals, with a growing presence across all provinces of Rwanda.

European Investment Bank (EIB Global) Vice President Thomas Ostros, visiting the garment factory[PHOTO NT]

European Investment Bank (EIB Global) Vice President Thomas Ostros, visiting the garment factory[PHOTO NT]

Challenges and future endeavours

The size of the apparel market in Rwanda, as of 2024, was $426.10 million, with a projected annual growth rate of 3.41% between 2024 and 2028. A 2023 UNESCO report, The fashion sector in Africa: Trends, challenges, and opportunities for growth, highlights Africa as one of the next frontiers for fashion. Rwanda is also listed as an African country with a growing local high-fashion luxury brand presence.

Despite these positive trends, Murebwa still faces challenges that hinder her work. She identified access to finance as a major obstacle. Moreover, the impact of the strong US dollar is a concern, as her company relies on importing all its raw materials.

“Delays in shipping also disrupt my factory’s workflow when urgent orders are required,” she says.

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of the garment factory at Gisozi in Kigali[PHOTO NT]

Thomas Ostros, European Investment Bank (EIB Global) Vice President during a guided tour of the garment factory at Gisozi in Kigali[PHOTO NT]

“Acquiring skilled manpower remains a challenge, especially for roles like textile engineers and quality assurance personnel, as they are costly to hire from abroad. I suggest that the government establish faculties related to these trades in universities to develop local talent,” she adds.

On a personal note, Murebwa continues to grapple with balancing her work life and family commitments. Her business requires a significant time investment, and she often finds herself struggling to find a balance. Looking ahead, Murebwa’s New Kigali Designers and Outfitters is in the final stages of opening a second phase of its factory at the Kigali Special Economic Zone.

“The new phase will house 300 staff [in addition to the 280 already employed] and incorporate high-tech machinery. This will enhance our ability to target export markets. Our focus will be on producing a variety of t-shirts to ensure affordability for all,” Murebwa says.

New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector [PHOTO NT]

East Africa Textile and Leather Week (EATLW) 2024 is set to be the premier event in the East Africa region showcasing the best in textile, leather, and fashion industries. With over 150 brands exhibiting and more than 3,000 traders from 30 countries expected to attend, EATLW promises to be an unrivaled platform for trade and innovation.

The event will commence on May 23, 2024, at Sarit Expo Centre in Nairobi, Kenya, at 10:00 am. The grand inauguration will be led by Dr. Juma Mukhwana, PhD, CBS, Principal Secretary for the State Department of Industry in the Ministry of Investments, Trade, and Industry, along with representatives from key partners including Kenya Export Promotion and Branding Agency (KEPROBA), Export Processing Zones Authority (EPZA), Kenya National Chamber of Commerce and Industry (KNCCI), Africa Leather and Leather Products Institute (ALLPI) and International Trade Centre (ITC).

Experience the cutting-edge innovation of will be exhibited at the East Africa Textile & Leather Week 2024 [PHOTO INSIDE OF THE RIVATEX EAST AFRICA]

Experience the cutting-edge innovation of will be exhibited at the East Africa Textile & Leather Week 2024 [PHOTO INSIDE OF THE RIVATEX EAST AFRICA]

The RIVATEX EAST AFRICA founded in 2007 as a Moi University facility, Rivatex is a vertically integrated textile factory, transforming cotton lint into a range of high-quality fabrics. Their ultramodern apparel and garment-making unit utilizes state-of-the-art machinery, producing diverse outfits from cotton and cotton blend fibers. The Rivatex products reach independent retailers, schools, universities, and manufacturers nationwide, while also serving markets in Rwanda, Burundi, Uganda, and South Sudan. Attendees will be able to chat with the RIVATEX EAST AFRICA team as well as their fabrics and services.

During the opening ceremony, the attendees will also have the opportunity to engage in an official tour alongside government officials and event organizers, providing a glimpse into the vibrant showcase of textiles, accessories, footwear, and leather products.

"We are thrilled to bring you East Africa Textile and Leather Week 2024, which will feature a very engaging lineup of activities and expert discussions," says Mr. Negasi, CEO of Trade & Fairs East Africa LTD. "This year's edition will not only emphasize the importance of sustainability and innovation but will also highlight the many business opportunities within the thriving African textile and leather value chains."

Mr. Negasi, CEO of Trade & Fairs East Africa LTD [PHOTO NT]

Mr. Negasi, CEO of Trade & Fairs East Africa LTD [PHOTO NT]

The conference program consists of an impressive lineup of topics and speakers, all under the theme "Unleashing the Power of Sustainability and Innovation in Fashion" including discussions on sustainable fashion, market trends, regional trade opportunities, fashion entrepreneurship, and the rise and influence of Gen Z.

The discussion will feature the following esteemed panelists from diverse backgrounds

The discussion will feature the following esteemed panelists from diverse backgrounds

This year, EATLW welcomes the International Trade Centre (ITC) as a new partner, joining Africa Leather and Leather Products Institute (ALLPI) in contributing to a larger leather presence. Together they bring over 20 leather companies from Kenya, Tanzania, Uganda, Ethiopia, Rwanda, Burundi, and South Sudan. Major returning exhibitors include Star Sewing from Dubai, Desta Group from Ethiopia, Export Processing Zones Authority (EPZA), Carvico from Italy, and a diverse group from Asia.

Another major highlight of the event will be the much anticipated "Runway Kenya" fashion show in collaboration with Couture Africa which will feature stunning and creative designs and talents from the region.

Zia Africa from Kenya will showcase at the East Africa Textile and Leather Week (EATLW) 2024

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Made by Zia Africa [PHOTO EATLW]

Since 2013, Zia Africa has revolutionized Kenyan fashion by championing sustainability. This #MadeInKenya brand offers timeless, high-quality pieces for the modern, aspirational woman. Committed to eco-friendly practices, Zia believes fashion shouldn’t harm the planet. By 2025, their goal is to become Africa’s leading sustainable fashion platform.

Ambrosoli Creations from Uganda will showcase at the East Africa Textile and Leather Week (EATLW) 2024

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

Bag Made by Ambrosoli Creations brand based in Uganda [PHOTO EATLW]

The Ambrosoli Creations, spearheaded by Ambrose Angulo are manufacturers of branded and non-branded bags with an African touch. Based in Kampala, Uganda, they specialize in all sorts of bags for both women and men including backpacks, totes, handbags, and travel bags with canvas, denim, and leather being their core mediums.

F&M Brand from Kenya will showcase at the East Africa Textile and Leather Week (EATLW) 2024

F&M Brand from Kenya will showcase at the East Africa Textile and Leather Week (EATLW) 2024

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

Made by F&M Brand from Kenya [PHOTO EATLW]

The F&M (Fashion and Ministry) Brand is a faith-based fashion brand based in Nairobi, Kenya. The Made in Kenya brand believes in dressing a person externally with edgy, fashion forward, and exclusive designs but more so to dress them internally with grace, with power, and with the wholesome word of God. They are a Fashion brand with a difference. The creative force behind F&M Brand is Fridah Ongili. She loves to design pieces that are conversation starters, exclusive, and top tier as evidenced by their pieces. She also firmly believes that God gave her her gifts to impact the world for good and for God. She prays to raise a generation of Proverbs 31 women through her Fashion and Ministry.

DOLMEL from Ethiopia will showcase at the East Africa Textile and Leather Week (EATLW) 2024

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

Made by DOLMEL from Ethiopia [PHOTO EATLW]

The DolMel is an Ethiopian fashion brand bringing a unique approach that pushes the millennia-old tradition of hand-weaving into the 21st century. They do this by using high-tech digital reactive printing to produce rolls of various kinds of seamless patterns on a cotton hand-woven fabric. This later turns into bohemian inspired clothes that celebrates and expresses one’s unique identity.These innovative products are the first of their kind in the textile and fashion industry in Ethiopia.

Island Kikapus from Kenya will showcase at the East Africa Textile and Leather Week (EATLW) 2024 [PHOTO EATLW]

Island Kikapus from Kenya will showcase at the East Africa Textile and Leather Week (EATLW) 2024 [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

Made by Island Kikapus from Kenya [PHOTO EATLW]

The Island Kikapus brings you unique baskets that merge luxurious fashion and style, perfect for every season and mission. Transforming locally woven baskets into versatile works of art with leather and decorations like never before. Each basket is hand-painted and adorned with artistic decorations such as flowers, sequins, embroidery, and various accessories.

Circular Economy and Sustainability in Africa: Fashion and Textiles

The circular economy concept, which aims to minimize waste and maximize resource efficiency, has gained significant attention in the fashion and textile industry, particularly in Africa. The African continent faces unique challenges and opportunities concerning sustainable fashion and textiles.

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

The fashion and textile industries play a significant role in the circular economy and sustainability efforts in Africa. These industries face various challenges, including resource depletion, environmental pollution, and unethical labor practices. However, there are also opportunities for adopting circular economy principles to address these issues and promote sustainable development.

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

Textiles and clothing are a fundamental part of everyday life and an important sector in the global economy. Worldwide, the USD 1.3 trillion clothing industry employs more than 300 million people along the value chain, and the production of cotton alone accounts for almost 7% of all employment in some low-income countries. Out of the many African countries growing and selling cotton, eleven do so under the label Cotton Made in Africa (CmiA), representing 40% of African cotton production.

A woman holding cotton on a farm cotton [PHOTO NT]

A woman holding cotton on a farm cotton [PHOTO NT]

In Africa, cotton is almost exclusively grown by smallholder farmers, and there are very few large plantations. The cotton plant loves warmth: it needs about 200 days of sunshine in the season to flourish and bear fruit. For that reason alone, it does well in the dry or humid savannahs of Africa. The climate, with its high average temperatures and alternation between dry and wet seasons, favors the cultivation of this natural fibre crop.

Under the (CmiA) initiative, a total of 900,000 small-scale farmers across eleven African countries produce 715,000 tons of sustainable cotton for the international market and benefit from business and agricultural training. On the manufacturing side, historically, many African countries had vibrant textile industries, with long-standing links to EU-based brands and retailers. Although the biggest textile-producing countries today are China and India, “Made In Africa” is gaining traction, and many brands are moving their production from Asian to African countries, with Ethiopia positioning itself as a leader in the development of the textile industry in East Africa.

Inside a garment factory in Ethiopia [PHOTO NT]

Inside a garment factory in Ethiopia [PHOTO NT]

Currently, in sub-Saharan Africa, the combined apparel and footwear market is estimated to be worth USD 31 billion and the textile industry in Africa is estimated to grow at a CAGR of ~5% over the forecast period of 2019–2024. The demand for African designs, textiles, and garments is increasing within and beyond the continent. With the growing population and expanding middle classes, the demand for clothing (both local and imported) is expected to rise. African countries, such as Rwanda and South Africa, are planning to revitalize the national textile industry.

Inside a garment factory in Rwanda [PHOTO NT]

Inside a garment factory in Rwanda [PHOTO NT]

On the global stage, African fashion designers are gaining prominence and for many people, the African fashion industry remains a source of economic inclusion, innovation, and promotion of cultural identity.

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

These encouraging trends for the textile sector are not without challenges. Firstly, conventional textile manufacture is associated with labor rights violations; unsafe working conditions; excessive consumption of raw materials, water, and energy; use of Persistent Organic Pollutants (POPs) in industrial operations; as well as water and air pollution. As big brands are increasingly seeing Africa as a new destination for their production facilities, the risks of replicating the same environmental and social negative outcomes seen in some Asian countries are high.

Secondly, downstream, the impact of clothing waste is particularly devastating for African countries, where second-hand clothing is increasingly exported. In the capital of Ghana, the Accra Metropolitan Assembly picks up around 70 metric tons of imported clothing waste from the Kantamanto market every day, six days a week. A lack of capacity to collect and recover textiles leads to clothing being disposed of informally – meaning it is burned and the ashes are swept into the gutters, where it makes its way to the sea; or it is brought to ‘informal’ dumpsites. The total impact of leaching dyes, chemicals, and microfibres on the environment, people’s health, and biodiversity loss is significant.

Old clothes dumped in mixed with other trash [PHOTO NT]

Old clothes dumped in mixed with other trash [PHOTO NT]

According to Climate Action, the challenges of textile waste in Africa are numerous, with serious environmental, economic, and social consequences. " People on the red carpet wear outfits that they will never wear again This is to argue that the fashion sector lacks sustainability and environmental care, resulting in increased textile waste in Africa. The catchphrase is always “Who are you wearing” and there will be no recycled outfits on the next red carpet"

Furthermore, according to the Future Investment Initiative Institute, the fashion industry emits more than 1.2 billion tons of greenhouse gas emissions every year as more clothes are produced each year and worn for increasingly shorter periods. That represents one-tenth of total emissions, more than all foreign flights and maritime shipping combined. Fast fashion companies are dumping textile waste in Africa, exacerbating a cycle of environmental degradation and social injustice. Africa is at the center of the expanding textile waste challenge.

The case for a thriving textile industry is clearly emerging in Africa, with potential important gains in terms of job creation and skills development. A circular economy holds the key to a prosperous, inclusive, and resilient fashion industry in Africa while avoiding the drawbacks of the current linear system that have detrimental impacts on people’s well-being and the environment.

The Latest in African Print Patterns

African print pattern- Made in Africa dress [PHOTO NT]

African print pattern- Made in Africa dress [PHOTO NT]

African print patterns have always been a statement of culture, identity, and personal style. In 2024, we're seeing these prints evolve into even more intricate, bold, and dynamic designs. From the classic Ankara to the mesmerizing Kente, designers are pushing boundaries and blending patterns. African prints have always been very beautiful and colorful, but this year we've already seen that this has been turned up a notch.

African print patterns [PHOTO NT]

African print patterns [PHOTO NT]

Making the wearer of these colorful fabrics and gorgeous patterns feel royal. This is especially seen with the launch of the new silky Satin Royal fabric by Vlisco. The traditional fabrics we all know and love are still very much alive, but we think we'll be seeing more fabrics with new patterns and color pallets that will suit modern designs.

African print pattern- Made in Africa by Mille Colines [PHOTO MC]

Some information in this article is from the research by the Ellen MacArthur Foundation

Circular Economy and Sustainability in Africa: Fashion and Textiles

The circular economy concept, which aims to minimize waste and maximize resource efficiency, has gained significant attention in the fashion and textile industry, particularly in Africa. The African continent faces unique challenges and opportunities concerning sustainable fashion and textiles.

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

The fashion and textile industries play a significant role in the circular economy and sustainability efforts in Africa. These industries face various challenges, including resource depletion, environmental pollution, and unethical labor practices. However, there are also opportunities for adopting circular economy principles to address these issues and promote sustainable development.

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

Stunning Kimono created from upcycled fabrics by AFC in Kenya [PHOTO NT]

Textiles and clothing are a fundamental part of everyday life and an important sector in the global economy. Worldwide, the USD 1.3 trillion clothing industry employs more than 300 million people along the value chain, and the production of cotton alone accounts for almost 7% of all employment in some low-income countries. Out of the many African countries growing and selling cotton, eleven do so under the label Cotton Made in Africa (CmiA), representing 40% of African cotton production.

A woman holding cotton on a farm cotton [PHOTO NT]

A woman holding cotton on a farm cotton [PHOTO NT]

In Africa, cotton is almost exclusively grown by smallholder farmers, and there are very few large plantations. The cotton plant loves warmth: it needs about 200 days of sunshine in the season to flourish and bear fruit. For that reason alone, it does well in the dry or humid savannahs of Africa. The climate, with its high average temperatures and alternation between dry and wet seasons, favors the cultivation of this natural fibre crop.

Under the (CmiA) initiative, a total of 900,000 small-scale farmers across eleven African countries produce 715,000 tons of sustainable cotton for the international market and benefit from business and agricultural training. On the manufacturing side, historically, many African countries had vibrant textile industries, with long-standing links to EU-based brands and retailers. Although the biggest textile-producing countries today are China and India, “Made In Africa” is gaining traction, and many brands are moving their production from Asian to African countries, with Ethiopia positioning itself as a leader in the development of the textile industry in East Africa.

Inside a garment factory in Ethiopia [PHOTO NT]

Inside a garment factory in Ethiopia [PHOTO NT]

Currently, in sub-Saharan Africa, the combined apparel and footwear market is estimated to be worth USD 31 billion and the textile industry in Africa is estimated to grow at a CAGR of ~5% over the forecast period of 2019–2024. The demand for African designs, textiles, and garments is increasing within and beyond the continent. With the growing population and expanding middle classes, the demand for clothing (both local and imported) is expected to rise. African countries, such as Rwanda and South Africa, are planning to revitalize the national textile industry.

Inside a garment factory in Rwanda [PHOTO NT]

Inside a garment factory in Rwanda [PHOTO NT]

On the global stage, African fashion designers are gaining prominence and for many people, the African fashion industry remains a source of economic inclusion, innovation, and promotion of cultural identity.

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

A collection made in South Africa by THEBE MAUGUG [PHOTO THEBE MAUGUGU]

These encouraging trends for the textile sector are not without challenges. Firstly, conventional textile manufacture is associated with labor rights violations; unsafe working conditions; excessive consumption of raw materials, water, and energy; use of Persistent Organic Pollutants (POPs) in industrial operations; as well as water and air pollution. As big brands are increasingly seeing Africa as a new destination for their production facilities, the risks of replicating the same environmental and social negative outcomes seen in some Asian countries are high.

Secondly, downstream, the impact of clothing waste is particularly devastating for African countries, where second-hand clothing is increasingly exported. In the capital of Ghana, the Accra Metropolitan Assembly picks up around 70 metric tons of imported clothing waste from the Kantamanto market every day, six days a week. A lack of capacity to collect and recover textiles leads to clothing being disposed of informally – meaning it is burned and the ashes are swept into the gutters, where it makes its way to the sea; or it is brought to ‘informal’ dumpsites. The total impact of leaching dyes, chemicals, and microfibres on the environment, people’s health, and biodiversity loss is significant.

Old clothes dumped in mixed with other trash [PHOTO NT]

Old clothes dumped in mixed with other trash [PHOTO NT]

According to Climate Action, the challenges of textile waste in Africa are numerous, with serious environmental, economic, and social consequences. " People on the red carpet wear outfits that they will never wear again This is to argue that the fashion sector lacks sustainability and environmental care, resulting in increased textile waste in Africa. The catchphrase is always “Who are you wearing” and there will be no recycled outfits on the next red carpet"

Furthermore, according to the Future Investment Initiative Institute, the fashion industry emits more than 1.2 billion tons of greenhouse gas emissions every year as more clothes are produced each year and worn for increasingly shorter periods. That represents one-tenth of total emissions, more than all foreign flights and maritime shipping combined. Fast fashion companies are dumping textile waste in Africa, exacerbating a cycle of environmental degradation and social injustice. Africa is at the center of the expanding textile waste challenge.

The case for a thriving textile industry is clearly emerging in Africa, with potential important gains in terms of job creation and skills development. A circular economy holds the key to a prosperous, inclusive, and resilient fashion industry in Africa while avoiding the drawbacks of the current linear system that have detrimental impacts on people’s well-being and the environment.

The Latest in African Print Patterns

African print pattern- Made in Africa dress [PHOTO NT]

African print pattern- Made in Africa dress [PHOTO NT]

African print patterns have always been a statement of culture, identity, and personal style. In 2024, we're seeing these prints evolve into even more intricate, bold, and dynamic designs. From the classic Ankara to the mesmerizing Kente, designers are pushing boundaries and blending patterns. African prints have always been very beautiful and colorful, but this year we've already seen that this has been turned up a notch.

African print patterns [PHOTO NT]

African print patterns [PHOTO NT]

Making the wearer of these colorful fabrics and gorgeous patterns feel royal. This is especially seen with the launch of the new silky Satin Royal fabric by Vlisco. The traditional fabrics we all know and love are still very much alive, but we think we'll be seeing more fabrics with new patterns and color pallets that will suit modern designs.

African print pattern- Made in Africa by Mille Colines [PHOTO MC]

Some information in this article is from the research by the Ellen MacArthur Foundation

Made in Ethiopia collection by Afropian: A play on words between Ethiopian and African, Afropian is a lifestyle brand based in Addis Ababa that focuses on telling a story of African excellence, by Africans for the world. Though it is strongly centered on Ethiopia, it is a journey across the whole continent and its History.

During an exclusive side chat at Source Fashion in London, the president of Ethiopia's Hawassa Industrial Park Investors Association (HIPIA) Hibret Lemma, confesses Ethiopia is only just at the start of its shift away from relying solely on the US for its garment exports.

He admits losing AGOA was a big hit to the country's garment sector and it slowed down growth considerably. However, Ethiopia's garment suppliers were hopeful that AGOA would be reinstated by the end of 2022 and that hope continued again until the end of 2023.

The nation's apparel sector has now accepted the waiting game is set to continue, with even AGOA's existing members still waiting for the agreement to be extended beyond its 2025 expiry date.

Lemma states: "We're back to reality now so we’ve been looking at the Europe market for about a year but it’s still in the early stages." In fact, Lemma took part in a panel session at last summer's Source Fashion event where he explained why European fashion sourcing executives should consider tapping into Ethiopia's sourcing potential.

Ethiopia's main challenge since losing AGOA

In his one-on-one chat with Just Style, however, Lemma is much more frank about the challenges since losing AGOA. He notes the main problem for the Hawassa Industrial Park is that it was originally designed with the US fashion industry in mind.

It was built seven years ago with US fashion conglomerate PVH Corp as an anchor investor, so the factory lines were made for repetition and big volume orders. Ethiopia's manufacturers were not looking at other markets before the loss of AGOA so it meant cutting staff and employees having to go back to their rural homes.

Hawassa, which is still Ethiopia's biggest industrial garment factory park, had 4,500 employees at its peak. Since the end of the country's AGOA membership in 2022 this has dropped down to 3,000. For Lemma, losing staff due to war and economic issues was a major challenge and on top of that having less help from the government, due to it it having other priorities. He adds access to foreign currency has historically also been a problem, but that is getting better.

The silver lining is that most companies managed to stay at the park, despite some downscaling, but they are now looking for reasons to expand. Indeed, despite the loss of AGOA Lemma retorts proudly that only two companies have closed since 2021.

On the whole, Lemma believes the factories wanted to stay open, which shows the resilience and true long-term potential of Ethiopia's garment sector. Remarkably, some garment manufacturers are still working with the US market despite the extra costs of not having the AGOA advantage. Lemma suggests these companies have successfully mastered efficiencies such as discounts on transportation to make exporting to the US a profitable endeavour.

Arguably, the big lesson Ethiopia has learned after all this is not to rely on one market and one trade agreement, such as AGOA. It is the same lesson fashion retailers and brands learned during the COVID-19 pandemic when supply chain issues were rife. Diversification is key at both ends of the supply chain spectrum.

Ethiopian workers inside a clothing factory [PHOTO NT]

Pros and cons of exporting to Europe

There are still plenty of opportunities for Ethiopia's garment sector, however, Lemma accepts: "Adapting to the European market and fast fashion will require adjusting lines and having more agility, which takes time." He continues that styles and volume are different for European fashion brands and retailers so this is a challenge for its supply chain.

The French sporting brand Decathlon is namedropped as already sourcing from Ethiopia along with French department store Monoprix, which Lemma says shows the country does have some experience with the European market, but it's still at an infant stage from a scale point of view.

Just Style spoke to a number of Ethiopian garment suppliers while wandering around the responsible global fashion supplier trade show. Many of them were quick to cite Europe as their new target market. JP Textile Ethiopia's general manager Dick Sun noted that the UK announced duty-free benefits for Ethiopia last year, which is why he was keen to be at the London-based show.

However, Desta Garments PLC's general manager Eyob Bekele points out that Europe and the UK offer Ethiopia the same duty-free benefits as their Asian suppliers, so he views the likes of Bangladesh and Pakistan as real competition.

Bekele acknowledges that Ethiopia doesn’t have as much vertical sourcing, which makes it a challenge as Ethiopia has to buy materials from Asia, while also competing with the sourcing major continent on export price for its ready-made garments.

There is development in Ethiopia's cotton farms and companies are looking into backward integration in terms of developing the fabric, but it has to be sustainable, Bekele adds.

Lemma hopes verticality will be on the horizon for Ethiopia in the not too distant future. He stated: "We would love to see fabric mills and a ginning capacity. We also want our garment hub to be a leader in Africa. I hope in three or four years we will be a leader at least in sub-Saharan Africa".

For Bekele, sustainability is key as he points out that Europe in particular is looking for more sustainable options and higher quality fabrics. Plus, he agrees with Lemma that the US' consumer power is much bigger than Europe so his factory was not set up for the smaller volumes European brands and retailers are now requesting.

Demka Group's managing director Ayhan Demir explains his Turkish company opened an Ethiopia factory eight years ago. AGOA was a "big disappointment" and is the reason why his company has now "turned its face to Europe and the UK".

Demir shares UK retailers Matalan and Primark currently work with Demka Group's factory in Türkiye, but given the impact of the Red Sea crisis, he is hopeful the Ethiopia factory could become an attractive proposition for them moving forward.

Sumbiri Hela Intimate Apparel's general manager Ravi Jaya Thilaka also points out that Ethiopia is already producing highly technical garment products. He says his company has the first bra factory in East Africa which involves using high tech machinery. His factory has 3,000 employees and he is proud to say the workforce is trained and has a willingness to learn with potential for them to improve.

Ethiopian workers inside a clothing factory [PHOTO NT]

Will Africa be Ethiopia's next big opportunity?

Lemma describes Africa's consumer market as a real growth opportunity, but he notes you can't put a timeline on it as the free trade agreement for Ethiopia is not yet in operation. He is referring to the African Continental Free Trade Area Agreement (AfCFTA), which aims to create the largest free trade area in the world measured by the number of countries participating.

Ethiopia is yet to commence its trial but it is said to be making preparations with a view to diversifying its export products. Bekele believes that once the trade agreement is in operation the duty-free benefits will give Ethiopia a big opportunity. He notes volume is also substantial in Africa but affordability has to be a key part of any African consumer push.

Ethiopian workers inside a clothing factory [PHOTO NT]

For Bekele, another arguably missed opportunity to date that would prevent both the amount of excess garment waste that enters the region as well as the chance to boost Ethiopia's sourcing potential locally is for global fashion brands and retailers to open stores in the continent.

Bekele believes there is demand for it as many Africans currently buy branded products when they travel to Europe so he asks: "Why are chains not opening in Africa?"

Hirdaramani Apparel's group marketing consultant Tharumal Wijesinghe agrees that Africa's potential is "huge".

He maintains it is beneficial for his multinational company to stay in Ethiopia as it gives European fashion brands and retailers the chance to expand their sourcing in the region for the time being. However, like so many of the other Ethiopian garment manufacturers exhibiting at Source Fashion, Wijesinghe has still got his fingers (and toes) crossed for AGOA and its huge US consumer market returning in the near future.

Article souce : GlobalData

How Ethiopia's Apparel Sector is Combatting AGOA Uncertainty: Fashion's Next Sourcing Hub

Made in Ethiopia collection by Afropian: A play on words between Ethiopian and African, Afropian is a lifestyle brand based in Addis Ababa that focuses on telling a story of African excellence, by Africans for the world. Though it is strongly centered on Ethiopia, it is a journey across the whole continent and its History.

During an exclusive side chat at Source Fashion in London, the president of Ethiopia's Hawassa Industrial Park Investors Association (HIPIA) Hibret Lemma, confesses Ethiopia is only just at the start of its shift away from relying solely on the US for its garment exports.

He admits losing AGOA was a big hit to the country's garment sector and it slowed down growth considerably. However, Ethiopia's garment suppliers were hopeful that AGOA would be reinstated by the end of 2022 and that hope continued again until the end of 2023.

The nation's apparel sector has now accepted the waiting game is set to continue, with even AGOA's existing members still waiting for the agreement to be extended beyond its 2025 expiry date.

Lemma states: "We're back to reality now so we’ve been looking at the Europe market for about a year but it’s still in the early stages." In fact, Lemma took part in a panel session at last summer's Source Fashion event where he explained why European fashion sourcing executives should consider tapping into Ethiopia's sourcing potential.

Ethiopia's main challenge since losing AGOA

In his one-on-one chat with Just Style, however, Lemma is much more frank about the challenges since losing AGOA. He notes the main problem for the Hawassa Industrial Park is that it was originally designed with the US fashion industry in mind.

It was built seven years ago with US fashion conglomerate PVH Corp as an anchor investor, so the factory lines were made for repetition and big volume orders. Ethiopia's manufacturers were not looking at other markets before the loss of AGOA so it meant cutting staff and employees having to go back to their rural homes.

Hawassa, which is still Ethiopia's biggest industrial garment factory park, had 4,500 employees at its peak. Since the end of the country's AGOA membership in 2022 this has dropped down to 3,000. For Lemma, losing staff due to war and economic issues was a major challenge and on top of that having less help from the government, due to it it having other priorities. He adds access to foreign currency has historically also been a problem, but that is getting better.

The silver lining is that most companies managed to stay at the park, despite some downscaling, but they are now looking for reasons to expand. Indeed, despite the loss of AGOA Lemma retorts proudly that only two companies have closed since 2021.

On the whole, Lemma believes the factories wanted to stay open, which shows the resilience and true long-term potential of Ethiopia's garment sector. Remarkably, some garment manufacturers are still working with the US market despite the extra costs of not having the AGOA advantage. Lemma suggests these companies have successfully mastered efficiencies such as discounts on transportation to make exporting to the US a profitable endeavour.

Arguably, the big lesson Ethiopia has learned after all this is not to rely on one market and one trade agreement, such as AGOA. It is the same lesson fashion retailers and brands learned during the COVID-19 pandemic when supply chain issues were rife. Diversification is key at both ends of the supply chain spectrum.

Ethiopian workers inside a clothing factory [PHOTO NT]

Pros and cons of exporting to Europe

There are still plenty of opportunities for Ethiopia's garment sector, however, Lemma accepts: "Adapting to the European market and fast fashion will require adjusting lines and having more agility, which takes time." He continues that styles and volume are different for European fashion brands and retailers so this is a challenge for its supply chain.

The French sporting brand Decathlon is namedropped as already sourcing from Ethiopia along with French department store Monoprix, which Lemma says shows the country does have some experience with the European market, but it's still at an infant stage from a scale point of view.

Just Style spoke to a number of Ethiopian garment suppliers while wandering around the responsible global fashion supplier trade show. Many of them were quick to cite Europe as their new target market. JP Textile Ethiopia's general manager Dick Sun noted that the UK announced duty-free benefits for Ethiopia last year, which is why he was keen to be at the London-based show.

However, Desta Garments PLC's general manager Eyob Bekele points out that Europe and the UK offer Ethiopia the same duty-free benefits as their Asian suppliers, so he views the likes of Bangladesh and Pakistan as real competition.

Bekele acknowledges that Ethiopia doesn’t have as much vertical sourcing, which makes it a challenge as Ethiopia has to buy materials from Asia, while also competing with the sourcing major continent on export price for its ready-made garments.

There is development in Ethiopia's cotton farms and companies are looking into backward integration in terms of developing the fabric, but it has to be sustainable, Bekele adds.

Lemma hopes verticality will be on the horizon for Ethiopia in the not too distant future. He stated: "We would love to see fabric mills and a ginning capacity. We also want our garment hub to be a leader in Africa. I hope in three or four years we will be a leader at least in sub-Saharan Africa".

For Bekele, sustainability is key as he points out that Europe in particular is looking for more sustainable options and higher quality fabrics. Plus, he agrees with Lemma that the US' consumer power is much bigger than Europe so his factory was not set up for the smaller volumes European brands and retailers are now requesting.

Demka Group's managing director Ayhan Demir explains his Turkish company opened an Ethiopia factory eight years ago. AGOA was a "big disappointment" and is the reason why his company has now "turned its face to Europe and the UK".

Demir shares UK retailers Matalan and Primark currently work with Demka Group's factory in Türkiye, but given the impact of the Red Sea crisis, he is hopeful the Ethiopia factory could become an attractive proposition for them moving forward.

Sumbiri Hela Intimate Apparel's general manager Ravi Jaya Thilaka also points out that Ethiopia is already producing highly technical garment products. He says his company has the first bra factory in East Africa which involves using high tech machinery. His factory has 3,000 employees and he is proud to say the workforce is trained and has a willingness to learn with potential for them to improve.

Ethiopian workers inside a clothing factory [PHOTO NT]

Will Africa be Ethiopia's next big opportunity?

Lemma describes Africa's consumer market as a real growth opportunity, but he notes you can't put a timeline on it as the free trade agreement for Ethiopia is not yet in operation. He is referring to the African Continental Free Trade Area Agreement (AfCFTA), which aims to create the largest free trade area in the world measured by the number of countries participating.

Ethiopia is yet to commence its trial but it is said to be making preparations with a view to diversifying its export products. Bekele believes that once the trade agreement is in operation the duty-free benefits will give Ethiopia a big opportunity. He notes volume is also substantial in Africa but affordability has to be a key part of any African consumer push.

Ethiopian workers inside a clothing factory [PHOTO NT]

For Bekele, another arguably missed opportunity to date that would prevent both the amount of excess garment waste that enters the region as well as the chance to boost Ethiopia's sourcing potential locally is for global fashion brands and retailers to open stores in the continent.

Bekele believes there is demand for it as many Africans currently buy branded products when they travel to Europe so he asks: "Why are chains not opening in Africa?"

Hirdaramani Apparel's group marketing consultant Tharumal Wijesinghe agrees that Africa's potential is "huge".

He maintains it is beneficial for his multinational company to stay in Ethiopia as it gives European fashion brands and retailers the chance to expand their sourcing in the region for the time being. However, like so many of the other Ethiopian garment manufacturers exhibiting at Source Fashion, Wijesinghe has still got his fingers (and toes) crossed for AGOA and its huge US consumer market returning in the near future.

Article souce : GlobalData

Is Recycled Cotton Sustainable: What it is and All the Advantages of This Fabric?

“No new land is required in recycling cotton. We all know that cotton is a crop that requires vast amounts of land, often leading to habitat destruction and biodiversity loss. Recycled cotton reuses existing materials” Fashion and Textiles expert says

Cotton farming [PHOTO NT]

With increasing concern about the environmental impact of the fashion industry, more brands and consumers are looking for sustainable fabric alternatives. Recycled cotton has emerged as one promising eco-friendly option. But what exactly is recycled cotton and how does it stack up in terms of sustainability?

Over the years, an increasing focus on the theme of sustainability and environmental impact has revived ancient techniques of fabric recycling that were fading away. This is how recycled cotton is born.

Old and second hand clothes to be recycled [PHOTO NT]

ALSO READ: HOW FAR IS THE AFRICAN FASHION INDUSTRY? POTENTIAL, SUSTAINABILITY, AND CHALLENGES

Why does Cotton matter in the fashion industry?

Cotton is a natural and biodegradable fiber, and its traditional cultivation and harvesting practices require the extensive use of many resources and harmful inputs, such as the intensive use of hazardous pesticides. It is made from the natural fibers that grow in the bolls of the cotton plant.

Cotton ready to be harvested [PHOTO NT]

The fibers are basically cellulose polymers. The unique twisted, convolutions structure of cotton fibers gives cotton its special qualities like strength, absorbency, and breathability. Also, cotton is highly absorbent due to the presence of many hydroxyl groups in its cellulose molecules. This allows cotton to absorb and release moisture quickly. Cotton is an integral part of our everyday lives: it is the second most used fiber by the textile industry and is used across multiple categories of clothing, home textiles, and accessories. You might even be wearing something made of cotton right now. But have you ever stopped to consider whether this cotton is recycled? And if it were, would you be able to tell?

T-shirt made out of recycled cotton [PHOTO NT]

As the world becomes more and more aware of the textile waste crisis, and legislation coming into place to try to slow it down, it is important to understand the concepts within recycled cotton and the nuances you can come across.

People harvesting cotton [PHOTO NT]

According to fashion and textiles experts, there are many advantages of recycled cotton starting with the water usage in the process where it reduces water and energy use growing conventional cotton which is extremely water-intensive, with one kg of cotton requiring up to 20,000 liters of water. “Recycled cotton skips this agricultural stage, eliminating the tremendous water footprint. It also requires much less energy since there is no need for crop production and raw material processing” an Expert says

Cotton pieces to be recycled [PHOTO NT]

“When we recycle cotton fabrics and old clothes, it reduces waste and pollution an estimated 15% of fabric intended for clothing ends up as waste on the cutting room floor. Recycling captures this waste along with post-consumer cotton products and diverts it from landfills, incinerators, and the environmental pollution associated with them” Experts say

ALSO READ: AS EGYPT’S ECONOMY DIPS, SUSTAINABLE FASHION SOARS

Market Overview

The recycled cotton market comprises three main types: purified cotton, cotton blend, and others. Purified cotton refers to recycled cotton that has been extensively processed and refined to remove impurities, resulting in a high-quality and pure end product. Cotton blend involves the combination of recycled cotton with other fibers like polyester or viscose, leading to enhanced durability and functionality. The “others” category encompasses various recycled cotton products not falling under purified or blend types, such as mixed fiber textiles or innovative uses of recycled cotton in non-textile applications.

Sorting out different fabrics made of cotton to be recycled [PHOTO NT]

Recycled cotton had an estimated production volume of 300,000 tons in 2022, accounting for approximately 1% of total cotton production worldwide. This contrasts deeply with the approximately 25 million tons of virgin cotton produced annually. However, the demand for recycled cotton is anticipated to increase in the coming years.

Sorting out different fabrics made of cotton to be recycled [PHOTO NT]

The Scaling for Circularity Report highlights that Bangladesh, one of the major textile manufacturing hubs globally, generates around 330,000 tons of post-industrial cotton waste annually. Currently, only 5-7% of this waste is recycled into new fiber, leaving a huge opportunity untapped to close the loop and increase the recycling of this category of products, instead of downcycling it, incinerating it, or sending it to landfill.

Recyled cotton [PHOTO NT]

As the demand for recycled cotton is predicted to grow, it is important for consumers and professionals of the fashion and textiles industry to understand the differences in cotton recycling methods.

The major cotton producers are China (with about 5 million tons/year), the United States (with 4 million tons/year), India (2.5 million tons/year), followed by Egypt, Pakistan, Uzbekistan, Turkey, Australia, Argentina, Brazil, Greece, Sub-Saharan Africa, and South America, each with smaller shares.

Clothes made out of recycled cotton [PHOTO NT]

Given such a low starting fiber value, it is evident that recycling represents an additional cost and not an economic advantage. Recycling costs more than intensively cultivating cotton, which benefits from economies of scale, and this should not be surprising. In the costs of textile recycling, one must always consider manual selection of scraps, color sorting, and the resulting industrial process.

Clothes made out of recycled cotton [PHOTO NT]

The choice to purchase recycled cotton garments cannot be dictated by price advantage but by the desire to change one's approach and try to reduce one's impact on the environment. As always, the most sustainable choice for the planet is not necessarily the most economical for those of us who inhabit it.

LATEST NEWS

Rwandan Cesta Collective handbag brand Receives Investment from Meghan Markle

04 September 2024 3957 hitsRwandan Cesta Collective handbag brand Receives Investment from Meghan Markle Cesta baskets are handwoven of locally sourced, renewable resources, by…

Moshions in Italy: A Journey of Self-Discovery

28 August 2024 4070 hitsMoshions in Italy: A Journey of Self-Discovery The INZOZI FASHION EXPERIENCE 2024, organized by Moshions, promises to be a landmark…

Who Will Win for the Miss, Mrs., and Mr. Heritage International Kenya 2024?

27 August 2024 4847 hitsWho Will Win for the Miss, Mrs., and Mr. Heritage International Kenya 2024? Two weeks ago was a busy period…

La Femme Fashion Show 2024: 4th Edition Takes Center Stage in Kinshasa

25 August 2024 4062 hitsLa Femme Fashion Show 2024: 4th Edition Takes Center Stage in Kinshasa The vibrant city of Kinshasa is set to…

Where Fashion Meets Opportunity: The ASFW 2024 Updates in Addis Ababa

24 August 2024 4095 hitsWhere Fashion Meets Opportunity: The ASFW 2024 Updates in Addis Ababa As the Africa Sourcing and Fashion Week (ASFW) 2024…

All Set for the Novelty Fashion Week 2024, 6th September

24 August 2024 4095 hitsAll Set for the Novelty Fashion Week 2024, 6th September The vibrant city of Kigali is buzzing with anticipation as…

FASHION SHOPS

![8 Fashion Brands Already Confirmed to showcase at the EATLW 2024 [PHOTO RCFS]](/media/k2/items/cache/218fa54275e0e31c37b4e5091d9112ba_Generic.jpg)

![8 Fashion Brands Already Confirmed to showcase at the EATLW 2024 [PHOTO RCFS]](/media/k2/items/cache/edab5e545cc8cf6a49faaa8a9ea6a3d0_Generic.jpg)

![Workers at New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector[PHOTO NT]](/media/k2/items/cache/8462850dbb62c4bd159ee1ad55df6950_Generic.jpg)

![Workers at New Kigali Designers and Outfitters, a garment factory located in Gasabo district, Gisozi sector[PHOTO NT]](/media/k2/items/cache/7081cca2f9cd0c06f2cce9e93d01dda9_Generic.jpg)

![F&M Brand from Kenya will showcase at the East Africa Textile and Leather Week (EATLW) 2024 [POSTER EATLW]](/media/k2/items/cache/7ced67c0d648122bcae10129de981341_Generic.jpg)

![Circular Economy and Sustainability in Africa: Fashion and Textiles [PHOTO NT]](/media/k2/items/cache/68497d6cb194485d2759fde9466457b7_Generic.jpg)

![Ethiopian Workers inside a Clothing Factory [PHOTO NT]](/media/k2/items/cache/f9a9b7c9f33a923e5475b478a62125ae_Generic.jpg)

![Ethiopian Workers inside a Clothing Factory [PHOTO NT]](/media/k2/items/cache/3bd6583af5a14653b7b54db2c9fe7f3e_Generic.jpg)

![Cotton Yarns [PHOTO ELISABETH]](/media/k2/items/cache/de2df791682f079f8397226a3ff38bc7_Generic.jpg)